Use Ambrook’s Enterprises and Funding tags to stay on top of grant reporting requirements

Congratulations on securing a grant! You’re likely itching to start spending to get your project into motion, but it’s crucial to first understand the reporting requirements for your grant. Grant reporting helps donors ensure the provided funding is used both correctly and effectively. It also ensures grant recipients are compensated properly. Some grants award money as reimbursements. Instead of up-front payments, recipients are required to track and submit transactions to receive the approved funding. Grant donors may prefer this format as a preventative measure to avoid the misuse of funding.

Note: Refer to Ambrook’s Funding Library to check the terms of each grant so you know if a grant will provide you with funding up-front or via reimbursements. You can also find information on which types of expenses are covered by a grant and which are not.

Grants have varying reporting requirements, but you’ll likely need to prepare both financial and performance reports. The key to accurate reporting is robust tracking. If you’re able to trace every single expense and transaction to its origin, reporting will be a breeze. Below, we walk you through best practices for tracking and explain how you can use Ambrook’s Enterprises and Funding tags to create comprehensive reports that satisfy donors and pave the way for more funding opportunities.

Financial Reporting

Federally awarded grants generally require a Federal Financial Report (FFR), and privately awarded grants will likely have a similar requirement. Note the following when you receive your financial reporting requirements:

Reporting Period(s): Federal agencies and private donors will indicate whether reported periods are on a quarterly, semi-annual, or annual basis. Depending on the grant, you will be required to submit interim and final reports. Typically, interim FFRs should be submitted within 30 days of the end of a reporting period and annual & final reports must be filed within 90 days of the reporting period and project’s completion, respectively.

Reporting Items: FFRs can require reporting items such as:

Transactions

Cash Receipts

Cash Disbursements

Federal Share of Expenditures

Recipient Share of Expenditures

Note: Contact your project coordinator early on if you have questions about reporting requirements.

Add reporting period deadlines to your calendar and establish a system to track all of your transactions for smooth and efficient reporting. While many farmers use digital tools such as Excel, manually tracking expenses and receipts can still be laborious time-consuming work and leaves records susceptible to human error and disorganization. Spreadsheets are also difficult to navigate and update as operations scale. To avoid reporting inaccuracies and potentially jeopardize your funding, keep your bookkeeping in one platform.

Ambrook uses Funding tags to let users associate transactions to a particular funding source for convenient reporting. For example, take a reimbursement-based Cost Share or Grant like NRCS EQIP. Simply create and apply a tag to every transaction related to NRCS EQIP and then filter all of your transactions by the tag at the end of your reporting period to easily identify which transactions you need to be reimbursed for. You can create and apply tags for each source of funding you currently use, enabling you to track reporting requirements for multiple grants and loans at once with ease.

Customize tags to match the level of granularity you need for reporting. For example, for a Value-Added Producer Grant (VAPG) grant, you may want to separately track Processing Costs from Labor. Simply create additional tags for each Task type and tag transactions accordingly. For best reporting practices, upload receipts from every transaction to ensure you can easily reference specific details about your funding.

You can also use Enterprise tags to associate revenues and expenses with a particular line of business so you can zoom in and compare your cost and profit centers without being distracted by overhead costs. This doesn’t just save you time, but also allows you to make strategic decisions and adjustments on how to use your grant funding more effectively.

Note: To understand the business impact of funding & enterprise tags, read Paul Fantello’s story. With Ambrook’s tracking features, Fantello was able to gain increased visibility into his business and integrate new conservation practices. Over time, he will be able to see his cost structure change and track the conservation grants he receives to implement them within Ambrook.

Performance Reporting

In addition to financial reporting, many grants require performance or impact reporting. Performance reports usually involve a combination of qualitative and quantitative data and are intended to demonstrate the impact of a specific project on the farm operation, community, or environment. Best practices for performance reporting include defining project outcomes and their respective indicators.

View this Final Performance Report template from a Farmer’s Market and Local Food Promotion Program provided by the US Department of Agriculture (USDA) for reference.

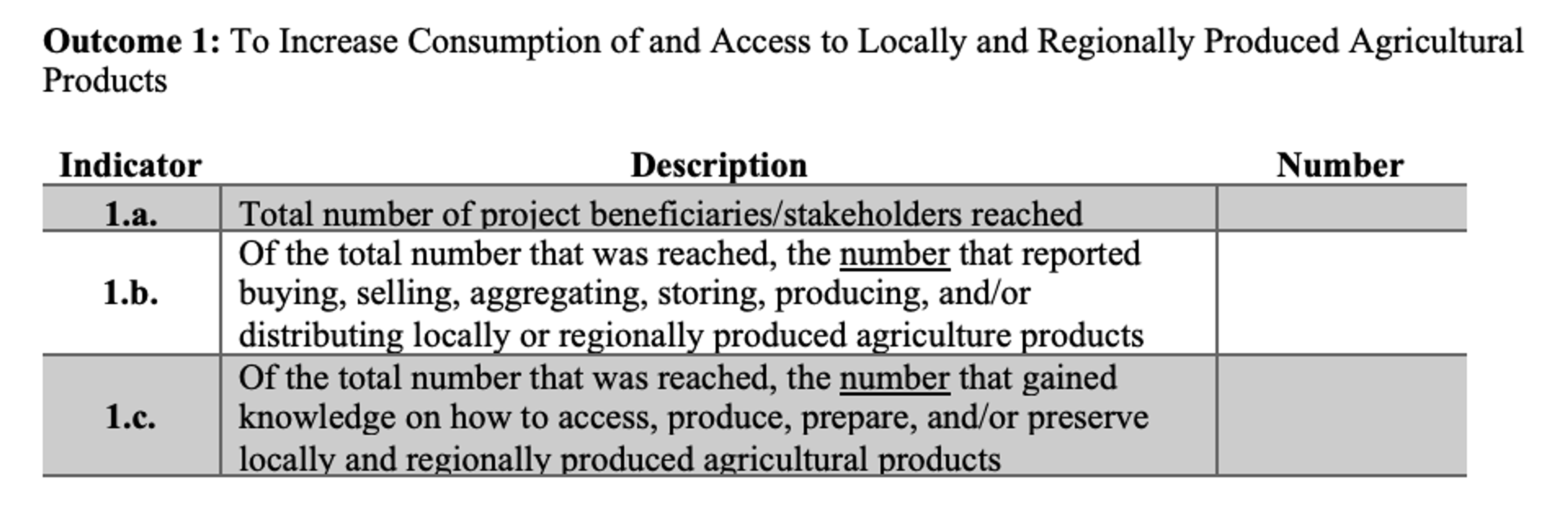

Note Outcome 1: “To Increase Consumption of and Access to Locally and Regionally Produced Agricultural Products”

Underneath the outcome, the grant recipient identified the following three indicators:

Total number of project beneficiaries/stakeholders reached

Of the total number that was reached, the number that reported buying, selling, aggregating, storing, producing, and/or distributing locally or regionally produced agriculture products

Of the total number that was reached, the number that gained knowledge on how to access, produce, prepare, and/or preserve locally and regionally produced agricultural products

By collecting data on each of these three indicators, the recipient will be able to report on whether their objective was reached or not. Clear and specific quantification can give grant donors the confidence to increase their investment and attract other donors looking to fund trustworthy projects with transparent reporting practices.

Tax Considerations

Tracking and reporting funding isn’t just necessary for fulfilling requirements for grant donors, but a necessary practice to ensure you’re able to effectively report the money received for tax season on the farm.

Federal grants are considered farm income and must be reported on your farm’s tax return. The IRS also states that a private foundation’s grants to organizations are typically taxable expenditures. Types of programs that create taxable payments include:

Conservation programs administered by the Farm Service Agency (FSA) and Natural Resource Conservation Service (including EQIP)

Crop disaster payments

Assistance for distressed borrowers

Ambrook can help you not only track your transactions through funding tags, but also prepare you for tax season by keeping your books up-to-date by:

Ensuring all your transactions are categorized

Organizing your receipts and associating them with the right transaction

Reconciling your books with external statements to verify accuracy

By keeping all of your financial data and reporting in Ambrook, you can easily assess how a grant benefited your operation in terms of increased revenue and profit and are equipped with the data to win more operation-enhancing grants in the future.

Secure funding faster by maintaining accurate books. Get a demo on how Ambrook provides you with the tools for comprehensive farm accounting that can make grant reporting pain-free, enabling business growth and operational efficiency.