What to expect as the year comes to a close and some suggestions on how to start the new year right

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.

Maintaining your books while managing your farm operation can be daunting. If you are feeling behind as you enter tax season, here’s a quick reminder of what to expect as the year comes to a close, and some suggestions on how to start the new year right.

Closing the Books

The goals of tax season are

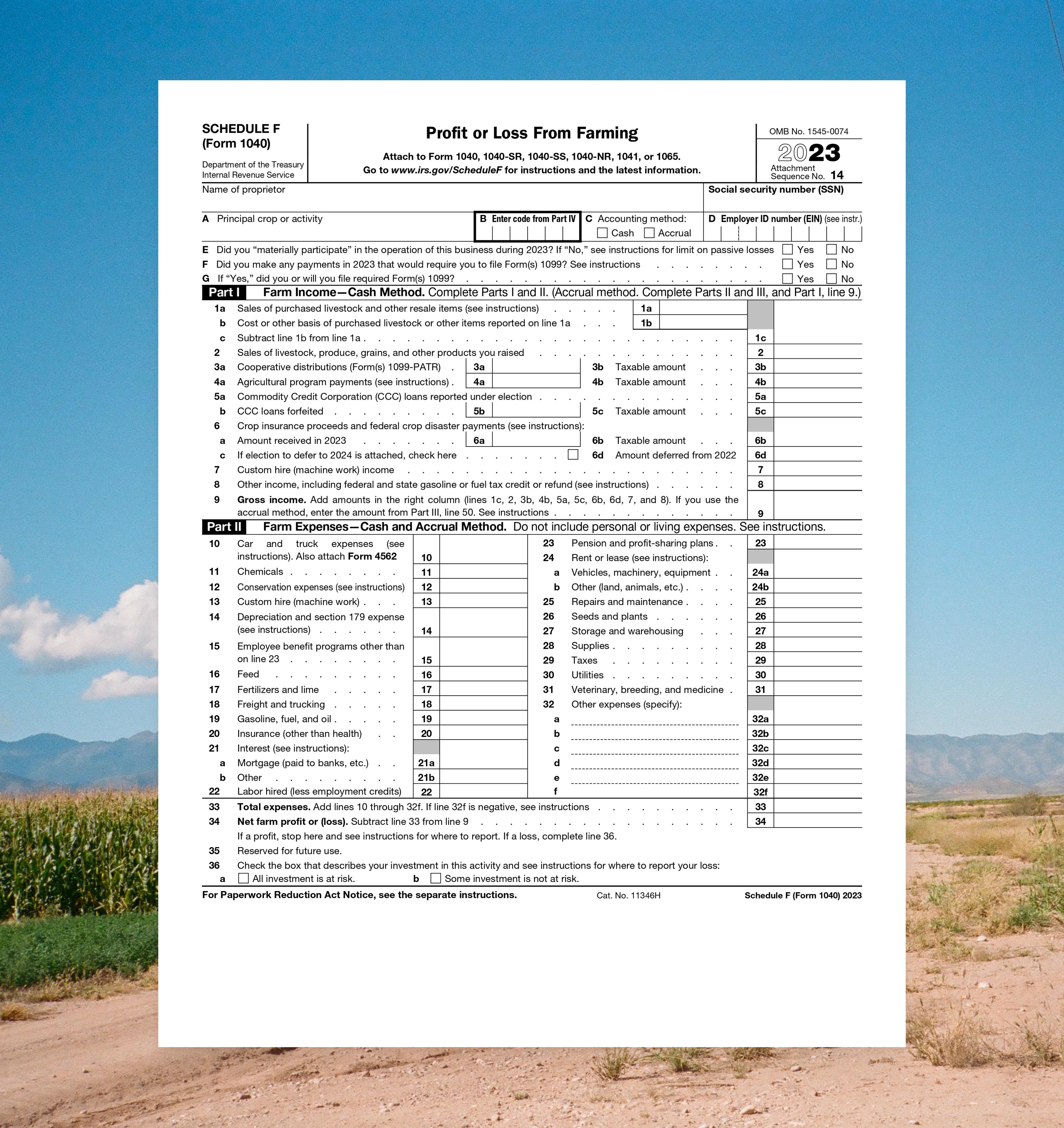

Accurate filing. The primary goal is to accurately file all required tax forms and documents before the deadline. This ensures compliance and avoids penalties.

Minimize tax liability. Maximizing deductions, depreciating assets, and accounting for losses are just a few ways you can minimize the amount of taxes your farm owes.

Tax planning. Tax season is a time to assess your financial position as well as reflect on your processes, from the field to the back office.

How you should prepare

Ahead of tax preparation, it’s critical that your recordkeeping is up to date. You’ll want to:

Ensure all your transactions are categorized.

Organize your receipts and associate them with the right transaction.

Make sure your books are reconciled with external statements to verify accuracy before filing taxes.

What to expect from your accountant

Once you are caught up on your recordkeeping, your accountant can begin tax preparation. Every operation has different needs, but your accountant will most likely be focused on the following:

Resolving errors. Complete books illuminate obvious errors. Your accountant can review reports to spot obvious anomalies that should be corrected ahead of filing.

Identifying potential deductions. With visibility into your full financial picture, your accountant can spot tax deduction opportunities you may have overlooked.

Calculating depreciation. Your accountant will determine the depreciation of any farm assets, machinery, buildings, etc. and record it properly.

Making any needed adjustments. Your accountant can make adjustments like accrual-to-cash conversions and record one-time transactions so your books are tax-ready.

Recommending tax strategies. With a complete financial picture, your accountant can recommend personalized tax planning strategies to reduce what you owe.

Filing your taxes. Finally, your accountant can handle completing and filing your various required business tax forms.

Entering the New Year

While the immediate goal of tax season is to file your taxes, farm operators should also view it as a time to reflect on their holistic operation. Here are some items to consider:

Could your Chart of Accounts be streamlined to improve accuracy and simplify recordkeeping?

What enterprises flourished this year? Which ones struggled? How might you optimize your operation for profitability in the new year?

What funding programs or grants could help your operation reduce costs, manage risks, and invest in the future?

Are there any business structure changes, like establishing new entities, that your operation should consider for the start of the year?

How might you establish habits that simplify record-keeping in the new year?

Meet Ambrook

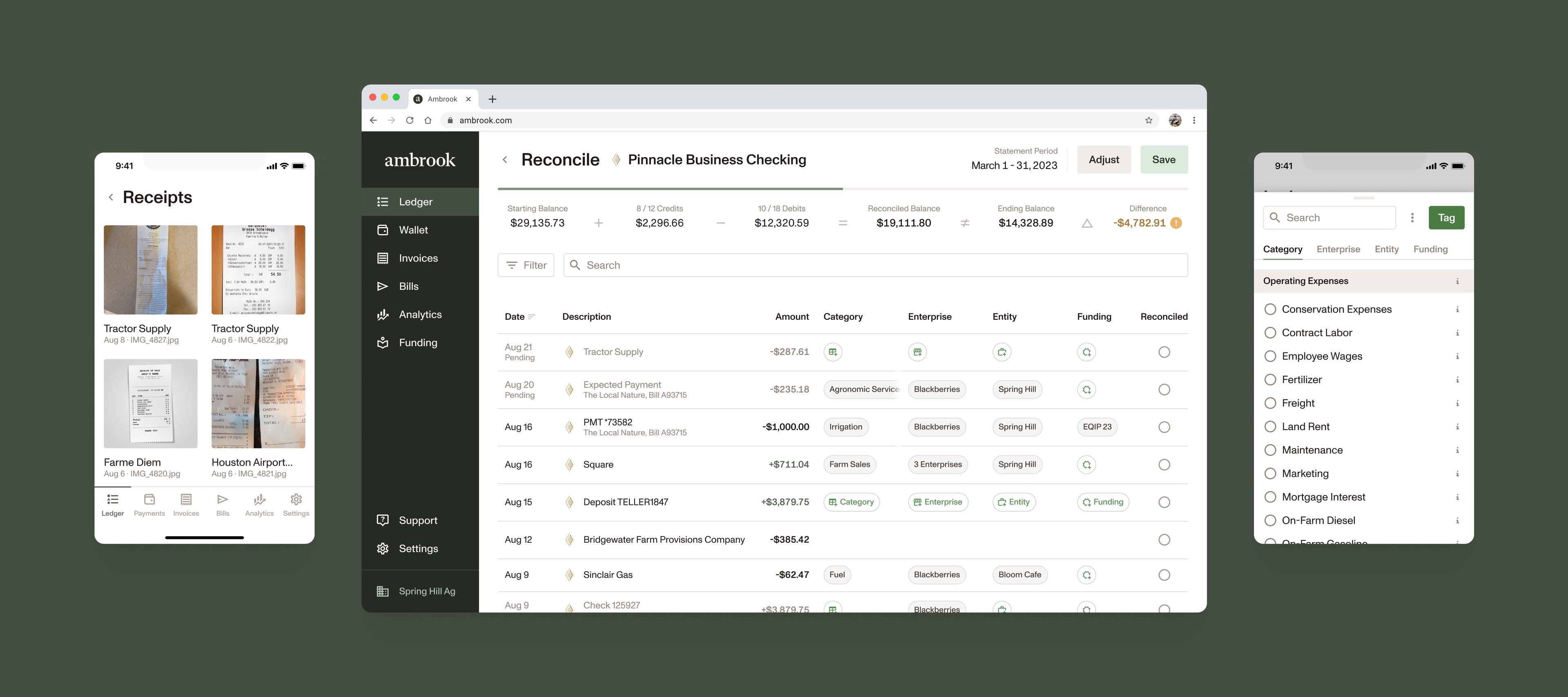

A smooth tax season starts with Ambrook, the accounting platform built for farms. Farmers love Ambrook because it simplifies recordkeeping. From taking pictures of receipts at the time of transaction to setting up rules that automatically tag transactions, Ambrook eliminates the busywork associated with bookkeeping by encouraging recordkeeping at the right times and by automating away repetitive tasks. This all leads to cleaner books, delighting accountants.

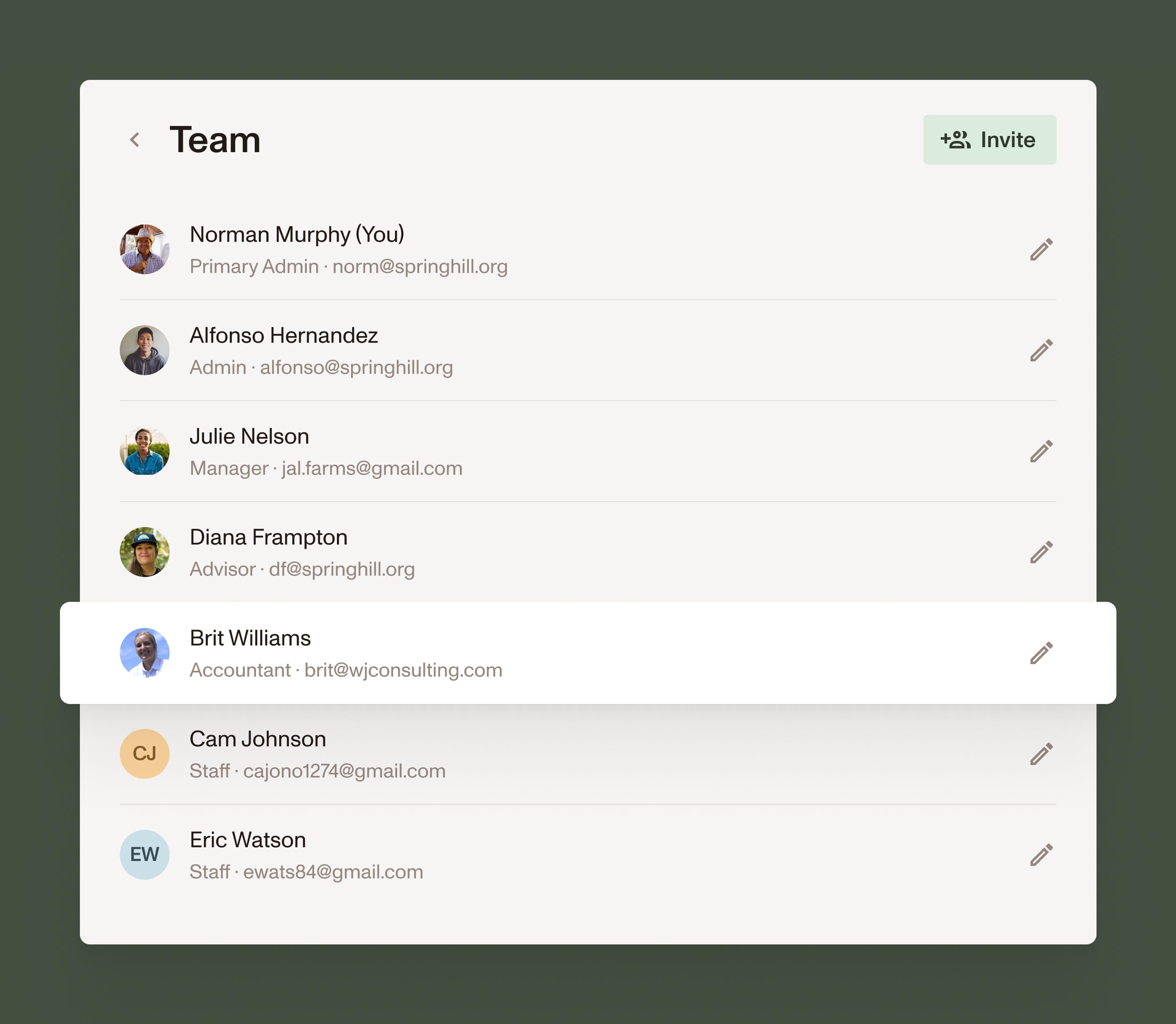

Your accountant will also love Ambrook’s reporting and reconciliation features that will enable them to resolve errors, identify deductions, ensure accuracy, and file your taxes more expediently. And best of all, Ambrook is a collaborative platform, so you, your accountant, and any one else on your team can pitch in.

Are you ready to simplify your bookkeeping in 2024?

Learn about Ambrook