If your business employs farmworkers and withholds payroll taxes from their wages, you’ll need to report them to the IRS using Form 943.

If you employ any farm workers as employees, there’s a very good chance you’ll need to file Form 943. This form reports the total federal income tax, Social Security and Medicare tax, and any Additional Medicare Tax you withheld from employee wages over the course of the year.

Here’s how to file Form 943 completely and on time.

What is Form 943?

If you have farmworkers and you withhold payroll taxes (social security and Medicare taxes) and income tax from their wages, you report it on Form 943.

(Note that this only applies if you farm for profit, not as a hobby.)

Farmworkers are any employees engaged directly in day-to-day operations of your farm. Employees who work in a non-farm capacity are not included.

Examples of non-farm workers include employees of a bed and breakfast located on the farm, workers in processing facilities for secondary products (eg. brewing, baking, cooking, preserves), or onsite rentals (eg. for weddings or other events).

IRS Form 943 deposit requirements and withholding

In order to qualify for withholding and depositing payroll tax:

Employees must earn $150 or more in wages over the course of the year; or

You must pay $2,500 in total wages over the course of the year.

If none of your employees earn $150 in wages, but the total wages you pay are $2,500 or more, you must file Form 943. You must also file if your total wages paid is less than $2,500, but any of your employees earn $150 or more.

In the event you withhold less than $2,500 in payroll tax, you aren’t required to deposit it over the course of the year. You can deposit it all at once when you file Form 943.

That being said, if you’re unsure whether you will withhold more than $2,500 over the course of the year, you’re better off making deposits anyway and avoiding potential failure to deposit penalties.

Contractors and Form 943

If you have contractors working for you over the course of the year, you report fees paid to them with Form 1099-NEC. Their pay is not included on Form 943.

Form 943 vs. Form 941

Form 943 is very similar to Form 941, which is used to calculate and report payroll and income tax withholding for employees.

One key difference: Form 943 is exclusively for farmworkers, while Form 941 applies to all other types of employees.

If you only employ farmworkers, you only need to file Form 943. If you employ both farmworkers and regular employees, you need to file both Form 943 and Form 941.

Example: You employ three farmworkers on your fruit orchard. You also have a second house on the property that you rent out as a bed and breakfast, and you have a fourth employee who manages it. Each year you file Form 943 to report the tax withholdings for the first three employees on the farm. You also file Form 941 to report the tax withholdings for the fourth employee who is not a farmworker and manages your B&B.

Form 943 due date

You must file Form 943 by January 31st each tax year. If you deposited payroll taxes over the course of the year, you have an automatic 10 day extension on that deadline. (This applies only to farms and ranches.)

After the first time you file Form 943, you must file it every following year. In order to stop filing in the future, you need to file a final return (indicated by checking a box at the top of the form).

How to file Form 943

You can file Form 943 either by mail (print copy) or online.

Form 943 mailing instructions

To file by mail, complete Form 943 and mail it to the relevant IRS address. The location where you mail copies of Form 943 varies depending on where your business is based and whether you’re sending a payment with the form. Check out this IRS table to find the correct Form 943 mailing address based on your location.

If there is an outstanding balance due—that is, if you owe unpaid payroll or income tax withholdings for the year—you must pay it at the same time you file. You can do so either by submitting a check or money order by mail or by using the Electronic Federal Tax Payment System (EFTPS).

Form 943 online filing instructions

If you do your own taxes, you can file Form 943 online using the IRS e-file system.

If you pay an accountant or tax preparer to file your taxes for you, they are able to file your taxes online on your behalf.

Form 943 instructions line by line

Form 943 is one of the shorter and more straightforward parts of your tax return. That being said, it’s important you fill out this form correctly to avoid unneeded back-and-forth with the IRS.

Keep the year’s completed Form W2s, as well as records of monthly or semiweekly deposit statements, on hand while you fill out this form. They are helpful for cross-checking the information you enter and making sure it’s accurate.

These Form 943 filing instructions use the IRS Form 943 for 2024.

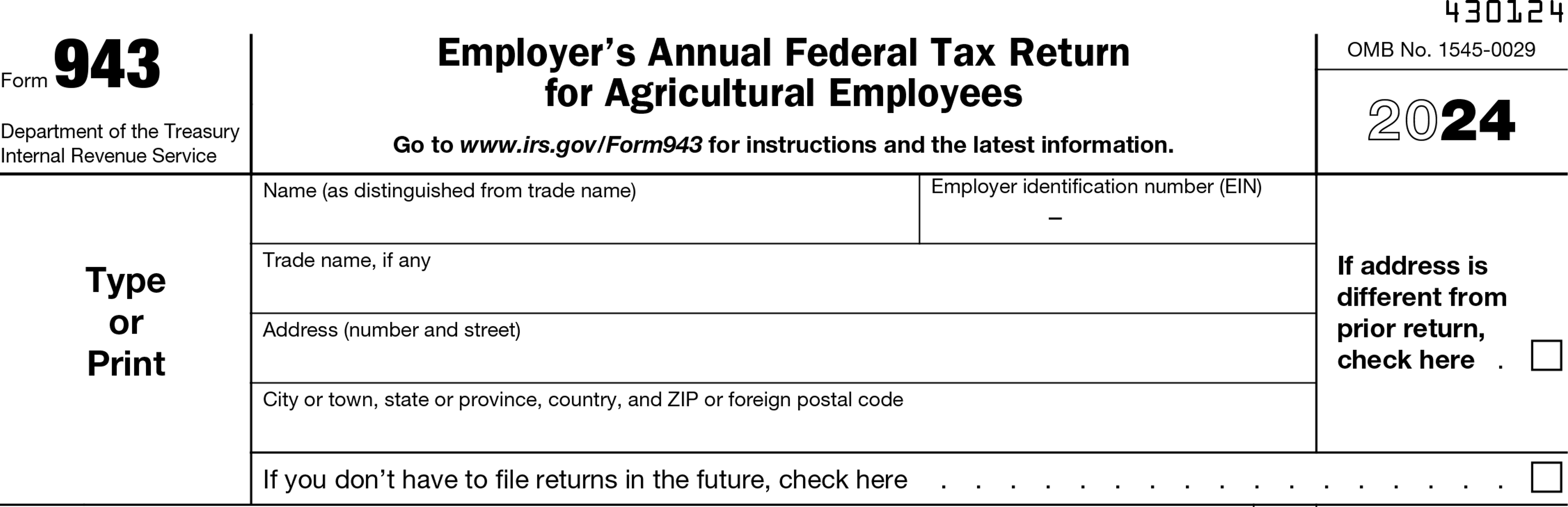

Basic information

This section is self-explanatory. If your address changed this year, or if you don’t anticipate filing Form 943 in the future, check the appropriate boxes.

Main section (lines 1 – 16)

Lines one through 16 make up the meat of Form 943. This is where you’ll enter information on wages paid and calculate your total withholding for the year.

Line 1. List the total number of employees you employed during the payroll period that included March 12.

Line 2. Enter the total amount of wages paid to employees that is subject to social security tax. Premiums for accident or health insurance you paid, or health savings account (HSA) contributions you made on behalf of employees, are not subject to social security tax. Remember, for 2024, only the first $168,600 of an employee’s wages is subject to social security tax.

Line 3. Multiply total wages subject to social security tax (line 2) by 12.4%, the social security tax rate.

Line 4. Enter the total amount of wages paid to employees that is subject to Medicare tax. As with social security tax, premiums for accident or health insurance you paid, or health savings account (HSA) contributions you made on behalf of employees are not subject to Medicare tax. Unlike social security taxes, there is no cap on wages subject to Medicare tax.

Line 5. Multiply total wages paid subject to Medicare tax by 2.9%, the Medicare tax rate.

Line 6. Employees earning $200,000 or more in wages are subject to Additional Medicare Tax of 0.9%. Enter total wages paid to employees subject to this tax here.

Line 7. Multiply total wages paid to employees subject to Additional Medicare Tax by 0.9%, the Additional Medicare Tax rate.

Line 8. Enter the total income tax withheld from all employees over the course of the year.

Line 9. Enter the total social security, Medicare, Additional Medicare, and income tax withheld from employees’ wages over the course of the year.

Line 10. Enter adjustments to total tax collected here. That includes fractions of cents rounded up in calculating your total amount; taxes withheld from sick day pay; and social security and Medicare contributions you did not collect from employees because they were withheld and paid by a third party, like an insurance company or a state disability insurance fund.

Line 11. After adding the total adjustments from line 10 to the taxes entered on line 9, enter the total here.

Line 12. If you received payroll tax credits for increasing research activities, as calculated on Form 8974, enter them here.

Line 13. Adjust the amount on line 11 according to any nonrefundable credits entered on line 12, and enter the new total here.

Line 14. Enter the total payroll tax deposits you made over the course of the year, including overpayment from the prior year and Form 943-X, here.

Line 15. If the amount you were supposed to deposit for the year (line 13) is less than the amount you actually deposited for the year (line 14), calculate the difference and enter it here. This is the amount you still need to pay.

Line 16. If the amount you deposited for the year (line 14) is greater than the amount you actually owed (line 13), calculate the difference and enter it here. You can choose to carry the amount forward as credit towards next year’s payroll taxes or to collect it as a refund.

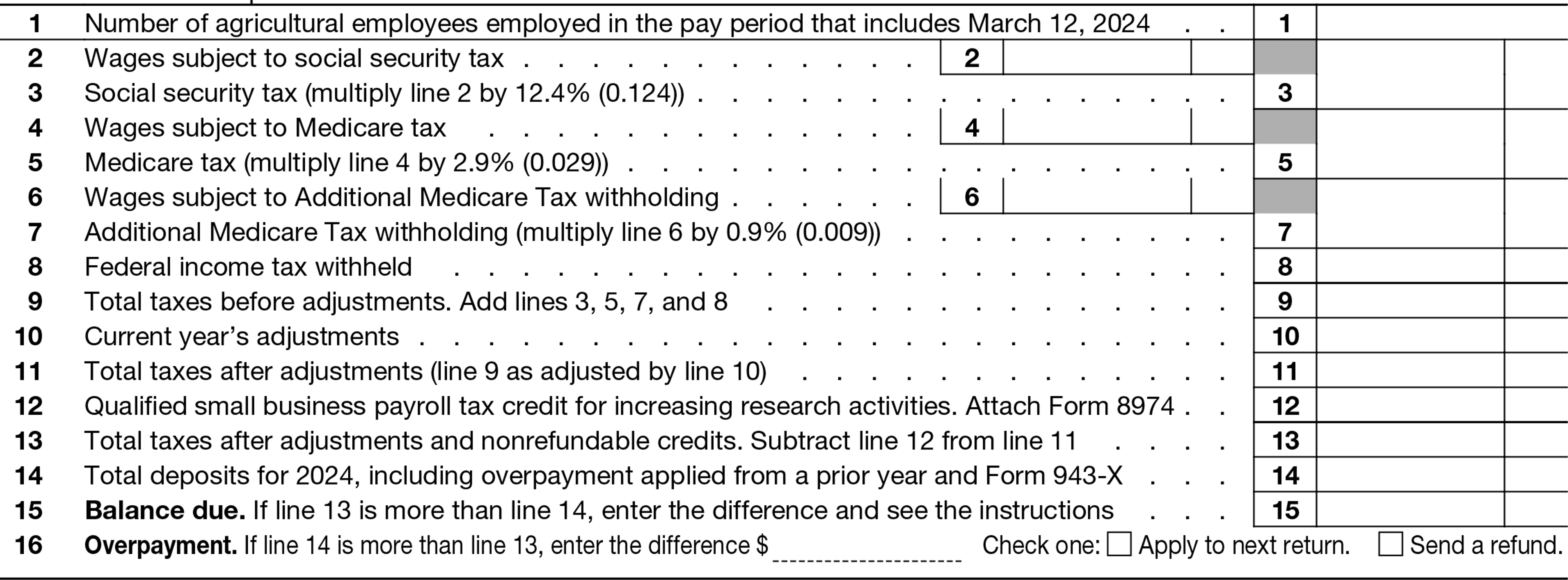

Monthly summaries (line 17)

Line 17. This section is where you enter a month-by-month breakdown of payroll taxes you deposited to the IRS over the course of the year. Consult your deposit records to find the total amount for each month.

If you deposited payroll taxes on a semiweekly schedule, check the appropriate box and attach Form 943-A, which you use to report the total amount owed day by day.

Finally, if the total amount of payroll tax owed, after nonrefundable credits, was less than $2,500, skip this section.

Box M is where you enter the total of boxes A through L. This should be equal to line 14.

Name and signature

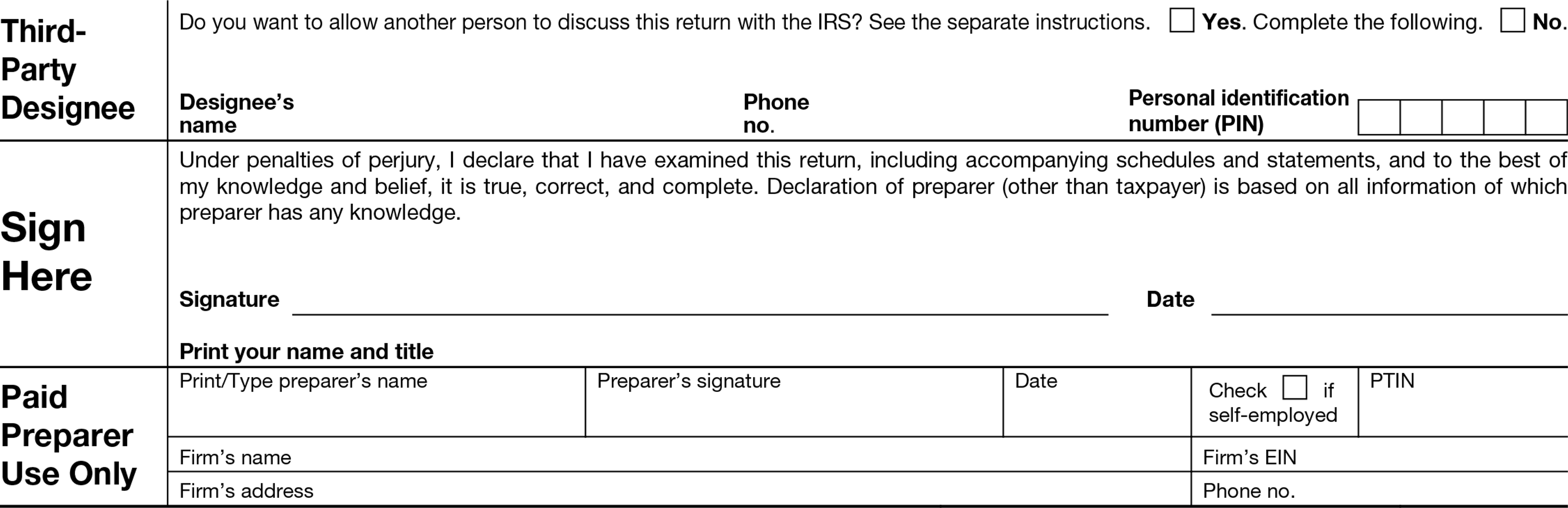

If you assigned a third-party designee to file your taxes for you, or if you hired an accountant to do so, this is where they enter their information. You also must enter your name, your signature, and the date of signing.

Make Tax Time Less Taxing with Ambrook

Keeping track of payroll taxes is easier when you use Ambrook. Just upload payroll reports from ADP, Gusto, QuickBooks Payroll, or other services to immediately calculate payroll expenses and enter them on the books.

With built-in support for Schedule F, time-saving bookkeeping automation features, streamlined bill pay and invoicing, and other powerful accounting and financial management tools, Ambrook doesn’t just make filing your taxes easy: it takes the guesswork out of running your business. Want to learn more? Schedule a demo today.

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.