Annual HVUT can total up to $550 per vehicle, but farmers can use Form 2290 to exempt their vehicles from the tax. Here’s how.

Any farm vehicle weighing over 55,000 pounds that you drive on public highways must be registered each year with Form 2290. This form helps you calculate and report the heavy vehicle use tax (HVUT) you owe the IRS.

Some good news: you also use Form 2290 to report exemptions from HVUT, specific to farmers, that apply if you meet certain conditions.

Here’s everything you need to file the form and take advantage of tax breaks for your farm.

What is Form 2290?

If a vehicle weighs over 55,000 pounds and it is being driven on public highways, the IRS requires you to file Form 2290 and pay HVUT. (“Public highways” includes all public roads.)

You file Form 2290 after you first drive the vehicle on a public highway, and then each following year in which you own the vehicle and continue to use it on public highways.

Form 2290 is used to report all vehicles you own subject to HVUT (or which would normally be subject to HVUT, but for whom the tax is being suspended).

What does Form 2290 cost?

HVUT for a single farm vehicle can range as high as $550 per year. This Form 2290 cost is based on how much the vehicle weighs. The tax may be reduced if you use the vehicle for only a portion of the reporting period (i.e., if you purchase it after the reporting period has begun, or sell it before the reporting period is finished).

Vehicles exempt from HVUT

Farm vehicles meeting certain requirements may be exempt from HVUT and do not need to be reported on Form 2290:

Mobile machinery

This includes vehicles that exist primarily as a means of moving machinery around the farm and not on public highways. If the machinery is mounted to the chassis in such a way that it’s difficult or impossible to remove, and the chassis would serve no other purpose if the machinery were removed, then it probably qualifies. A chassis specially designed solely for the purpose of pulling or carrying a particular piece of machinery, which has no other use outside that duty, also qualifies.

Vehicles designed for off-highway transportation

This includes any vehicle meant to pull trailers, carry loads, etc., that is unable, because of its design, to travel on public highways, or else unable to maintain a steady speed of 25 miles per hour on a public road.

Form 2290 requirements for tax suspension

If you own an agricultural vehicle and you drive under 7,500 miles on public roads during the reporting period, the HVUT is suspended. You don’t have to pay any tax at all—but you still need to file Form 2290.

Keep in mind that the 7,500 mile limit only counts the miles driven on public roads, not miles driven on your farm or ranch. It’s important, for every vehicle you report on Form 2290, to keep detailed mileage logs.

Filing an amended Form 2290

When you file and pay Form 2290, you do so in anticipation of how you will use the vehicle.

That is, you either plan to drive the vehicle over 7,500 miles on public highways, or you plan to drive it less than 7,500 miles. You also anticipate using the vehicle for the entirety of the reporting period.

You need to file an amended return (a second Form 2290, changing the details of the first) if:

You claimed on the first return that you would drive the vehicle less than 7,500 miles on public highways, but then drive it more than 7,500 miles

You claimed on the first return that you would drive the vehicle more than 7,500 miles on public highways, but then drive it less than 7,500 miles

You sell the vehicle before the end of the reporting period

Also, if you incorrectly enter a vehicle identification number (VIN) on Form 2290, you need to file an amended return with the correct VIN. Any other errors can also be corrected with an amended Form 2290.

What is a stamped Schedule 1?

Most states require you to provide a stamped copy Schedule 1 from Form 2290 in order to register a heavy vehicle for use on public highways.

When you fill out Form 2290 and submit it to the IRS, you complete two identical copies of Schedule 1. This page lists details of all the vehicles you’re reporting.

After filing, the IRS stamps and returns one of those Schedule 1 copies to you as proof HVUT payment.

For the sake of getting your vehicle licensed quickly, it’s a good idea to get Form 2290 filed and paid ASAP after purchasing a new or new-to-you heavy vehicle.

When to file Form 2290

Form 2290 follows a reporting period different from the January 1st to December 31st calendar tax year. Rather, it runs from July 1st of one year to June 30th of the next.

You’re required to file Form 2290 after the first time you use a heavy vehicle on public highways during the reporting period. The Form 2290 due date is the last day of the month following the first time you drive the vehicle on public roads.

Example #1: On May 12th, 2025 you buy a new farm vehicle weighing over 55,000 pounds and drive it home from the dealership. You are required to file Form 2290 by June 30th, 2025 for the reporting period running from July 1, 2024 to June 30th, 2025.

Example #2: On July 14th, 2025 you buy a new farm vehicle weighing over 55,000 pounds and drive it home from the dealership. You are required to file Form 2290 by August 31st, 2025 for the reporting period running from July 1st, 2025 to June 30th, 2026.

As with most IRS due dates, if the date falls on a weekend or a federal holiday, it jumps ahead to the next regular weekday.

Prorated HVUT on Form 2290

If you acquire a vehicle after July of the current reporting period, the total amount of tax you pay is prorated. That is, you don’t pay tax for the full 12 months of use between July 1st and June 30th.

While calculating your HVUT you refer to page 14 of the IRS Instructions for Form 2290. Your reduction in total tax is based both on the month you acquired the vehicle and the vehicle’s weight category.

Where to file Form 2290

Filing 2290 by mail

You can file a paper version of Form 2290 as long as you’re paying tax on fewer than 25 vehicles. If you pay the HVUT on more than 25 vehicles, you have to file electronically.

After completing Form 2290, including both copies of Schedule 1 and any supporting documents, mail it to the IRS by the Form 2290 due date.

The address you mail Form 2290 to depends on where your business is based. See page 4 of IRS Form 2290 Instructions to find the correct mailing address based on your location.

To pay any HVUT owing, enclose a check or money order along with Form 2290-V, the payment voucher stub at the end of the form. You can also make a payment through the Electronic Federal Tax Payment System (EFTPS).

You will receive a stamped copy of Schedule 1 from the IRS within six weeks.

Electronic filing Form 2290

The fastest way to get a copy of your stamped Schedule 1 is to e-file Form 2290. This method lets you print off a stamped copy of Schedule 1 (really a watermarked copy) immediately after you file and pay. You then have what you need to register your vehicle with the state.

After electronic filing Form 2290, you can pay online using debit or credit card, electronic funds withdrawal, or the Electronic Federal Tax Payment System (EFTPS).

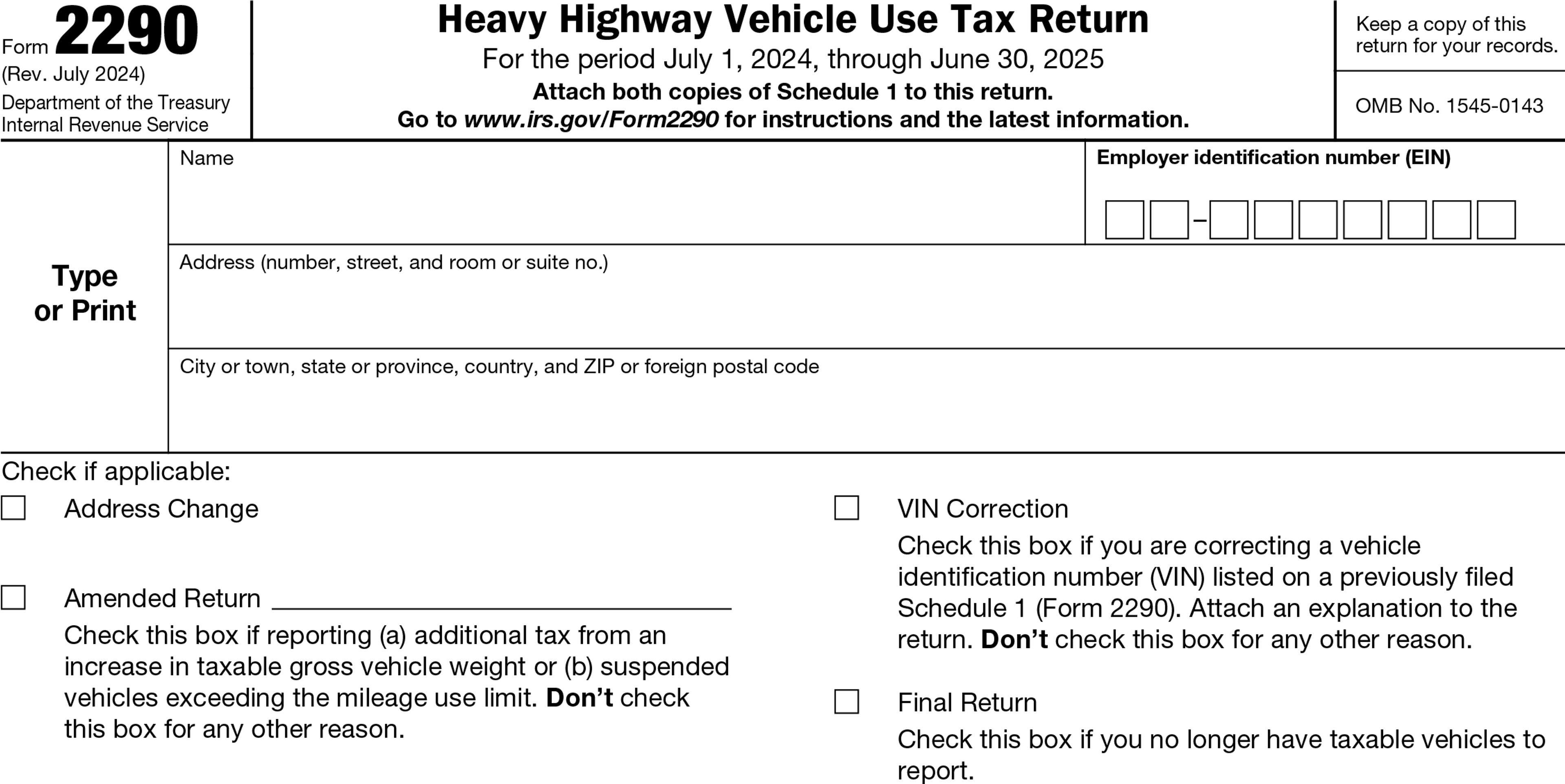

Form 2290 requirements for filing

Before sitting down to complete Form 2290, make sure you have the following personal and business information:

Your name and contact information

Your employer identification number (EIN)

For each vehicle you’re reporting, make sure you have:

Its taxable gross weight in pounds

Its VIN

The date you acquired the vehicle if it’s new for this reporting period

If you bought the vehicle used, the seller must provide you with a document including:

The seller’s name, address, and EIN

The vehicle’s VIN

The date of the sale

The odometer reading at the beginning of the reporting period

The odometer reading at the time of sale

Your own name, address, and EIN

Calculating vehicle weight

Depending on your vehicle’s weight, it will fall into one of 22 categories labeled A through V. (A 23rd category, W, applies to vehicles for which HVUT is suspended.) The weights applicable to these categories are listed on page 2 of Form 2290.

To find the taxable gross weight of a vehicle, add up:

The actual unloaded weight of the vehicle when it’s equipped for service. That means the total weight of the vehicle without a load, but including the weight of gas or diesel, oil, coolant, batteries, etc. necessary for it to operate.

The actual unloaded weight of trailers. These are any trailers typically used in combination with the vehicle.

The weight of the typical maximum load on the vehicle and connected trailers. This is the greatest weight you would typically carry or pull with the vehicle. If you have received a temporary permit to carry overweight loads on public highways, do not factor it in when calculating this amount.

The actual unloaded weight may be listed as the vehicle’s tare on a manufacturer’s spec sheet.

If you have already registered the vehicle in your state, the taxable gross weight you enter on Form 2290 cannot be less than the amount recorded on your vehicle registration.

How to complete Form 2290

You can use Form 2290 to report multiple vehicles, but for the sake of simplicity, this guide assumes you are reporting just one.

Basic information

Most of the fields at the start of Form 2290 are self-explanatory.

Pay special attention to the check boxes if you are filing Form 2290 as an amendment. For VIN corrections, you check one box. For adjustments to HVUT, you check another.

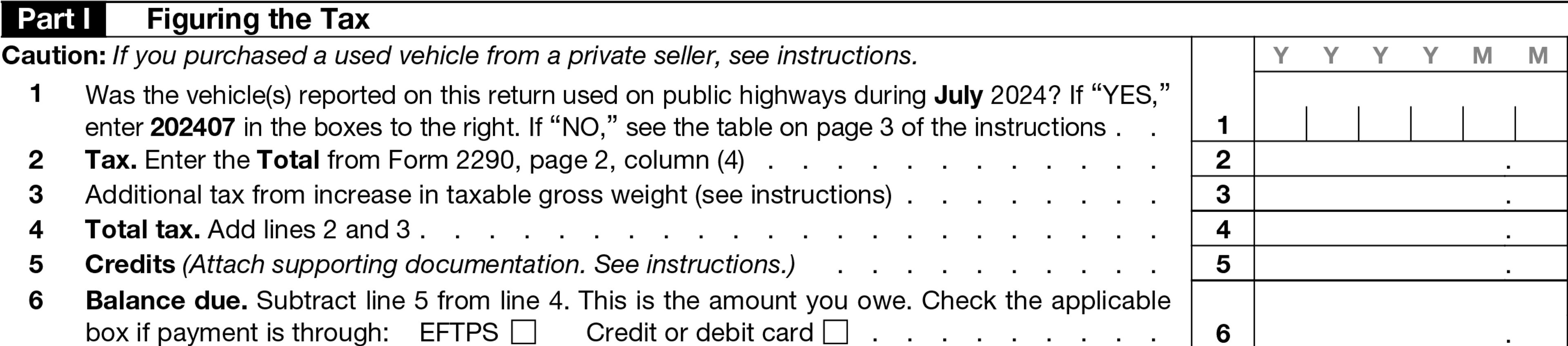

Line 1. If you already used the vehicles being reported during the prior reporting period, follow the instructions included on the line. Otherwise, refer to page 3 of the Form 2290 instructions to find the correct date code.

The date codes and cutoffs vary slightly from one year to the next based on when weekends and major holidays fall, but for the 2024 tax year they looked like this:

| IF, in this period, the vehicle is first used during... | THEN, file Form 2290 and make your payment by...* | and enter this date on Form 2290, line 1** |

|---|---|---|

| July 2024 | September 3, 2024 | 202407 |

| August 2024 | September 30, 2024 | 202408 |

| September 2024 | October 31, 2024 | 202409 |

| October 2024 | December 2, 2024 | 202410 |

| November 2024 | December 31, 2024 | 202411 |

| December 2024 | January 31, 2025 | 202412 |

| January 2025 | February 28, 2025 | 202501 |

| February 2025 | March 31, 2025 | 202502 |

| March 2025 | April 30, 2025 | 202503 |

| April 2025 | June 2, 2025 | 202504 |

| May 2025 | June 30, 2025 | 202505 |

| June 2025 | July 31, 2025 | 202506 |

* File by this date regardless of when the state registration for the vehicle is due. If any due date falls on a Saturday, Sunday, or legal holiday, file by the next business day.

** This date may not apply for privately purchased used vehicles. See Tax computation for privately purchased used vehicles and required claim information for sold used vehicles.

Line 2. Refer to page 2 of Form 2290 to find the applicable tax based on your vehicle’s weight category (covered below under “Tax Computation”) and enter it here.

Line 3. Only complete this line if the taxable gross weight of the vehicle is increasing for this reporting period. The Form 2290 Instructions include a worksheet for Line 3 for calculating this additional tax.

Line 4. This is where you enter the total of the tax reported on line 2 and any additional tax entered on line 3.

Line 5. Report any credits towards HVUT here. These credits may be the result of a vehicle being used less than 7,500 miles on public highways (where previously you paid HVUT in anticipation of driving over 7,500 miles), or the result of a vehicle being destroyed, stolen, or sold. Use Schedule 6 of Form 8849 to report any mistaken tax liability. Also use Form 8849 to claim the refund of any credits.

You must include a copy of the worksheet for figuring the credit included in the Form 2290 Instructions. If the vehicle was destroyed, stolen, or sold, also include a sheet explaining the loss of the vehicle.

Finally, for each vehicle for which you are claiming credit, provide:

The VIN

Its taxable gross weight category

The date of the loss of the vehicle

The name and address of the purchaser of the vehicle

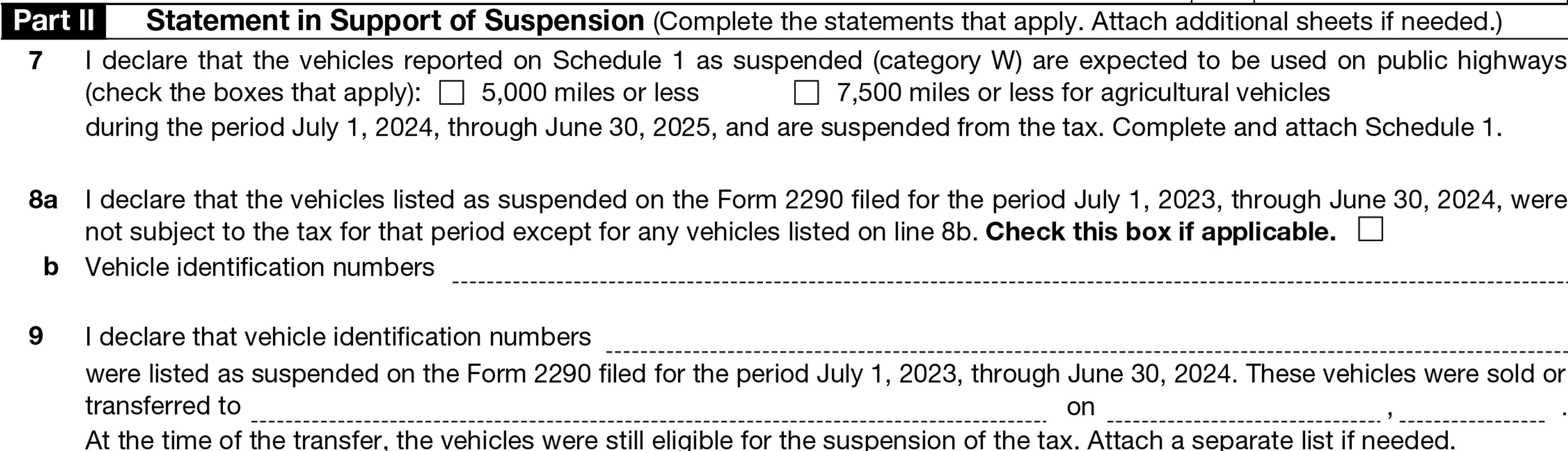

Statement in support of suspension

This section is where you report a farm vehicle you expect to drive less than 7,500 miles on public highways.

Line 7. This is a simple declaration of the fact that you expect the vehicle to qualify for suspension of HVUT.

Line 8a. If during the prior tax period (July 1st - June 30th) you checked off line 7, and the vehicle did in fact qualify for suspension (you drove it under 7,500 miles), check the box here.

Line 8b. If during the prior tax period (July 1st - June 30th) you checked off line 7, and the vehicle did not qualify for suspension (you ended up driving it for more than 7,500 miles), check the box and enter the vehicle’s VIN.

Line 9. If you bought a vehicle that was eligible for suspension of HVUT during the prior reporting period and then sold it during the current reporting period, and it was still eligible for suspension at the time you sold it, report details of the sale here.

Tax computation

This page is where you calculate the total tax reported on line 2. It’s also where you determine the vehicle’s weight category.

(In the case of multiple vehicles, they may belong to separate tax categories, or all to the same tax category.)

Note that if you purchased a vehicle after July of the reporting period, it qualifies for partial-period tax (column (2a)). This is a prorated amount of the tax listed in column 1a.

Use this table from the Instructions to calculate the partial-use tax (current for 2024):

Schedule 1

You will fill out two copies of Schedule 1. They are identical, but one copy will be returned to you as a stamped Schedule 1 which you can use to register your vehicle with the state.

The instructions are fairly straightforward. Refer to the tax computation page (above) to determine each vehicle’s weight category.

Taxes are easier with Ambrook

Since the reporting period for Form 2290 is different from the calendar tax year, you’ll find yourself filing it separately from the rest of your tax return.

Sound like a chore? It’s easier when your books are already taken care of. Ambrook’s farm-friendly category tags make it easy to compare your tax return to your records, saving you hours of work during tax season.

With time-saving bookkeeping automation features, automatically-generated financial reports, streamlined bill pay and invoicing, and other powerful accounting and financial management tools, Ambrook doesn’t just make filing your taxes easy: it takes the guesswork out of running your business.

Want to learn more? Schedule a demo today.

This resource is provided for general informational purposes only. It does not constitute professional tax, legal, or accounting advice. The information may not apply to your specific situation. Please consult with a qualified tax professional regarding your individual circumstances before making any tax-related decisions.