Learn about the building blocks of finance – journal entries.

Maintaining accurate financial records is part of any successful business venture. One fundamental aspect of creating those financial records is recording journal entries.

In this guide, we’ll explain what journal entries are, when to use them, and how to use them effectively.

What are Journal Entries?

Accounting journal entries are simply records of your business transactions. Every transaction that goes into your accounting software has a journal entry behind it. In most cases, you don’t see those journal entries because your accounting software syncs with your bank accounts to capture payments and deposits automatically, but they’re there.

Each journal entry includes a date, the accounts impacted by the transaction, the amounts to be credited and debited, and a brief description — all the details necessary for maintaining accurate financial records.

Example of a Journal Entry

Let’s look at a few examples to help you understand journal entries and how they work.

On June 1, you buy a new tractor for $30,000. You pay $10,000 down and finance the rest with a loan. The journal entry to record the transaction would look like this:

| June 1 | Account | Debit | Credit |

|---|---|---|---|

| Equipment | $30,000 | ||

| Cash | $10,000 | ||

| Notes Payable | $20,000 | ||

| Purchased a new tractor |

Let’s look at another. The next day, you sell produce worth $5,000, and your customer pays with a check. The journal entry would be:

| June 2 | Account | Debit | Credit |

|---|---|---|---|

| Cash | $5,000 | ||

| Sales Revenue | $5,000 | ||

| Sold Produce |

That same day, you pay cash for $500 worth of supplies. Your journal entry would look like this:

| June 2 | Account | Credit | Debit |

|---|---|---|---|

| Supplies | $500 | ||

| Cash | $500 | ||

| Purchased supplies |

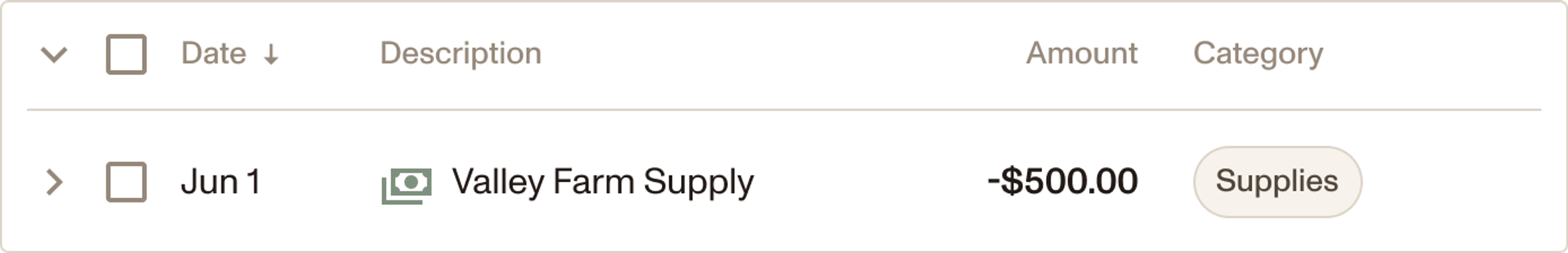

Your accounting software will likely simplify this journal entry. Here’s what this example would look like in Ambrook:

When Do You Use Journal Entries?

You (or your accounting software) use journal entries whenever a financial transaction occurs. This can include:

Purchasing supplies: Recording the purchase of seeds, fertilizers, or feed.

Selling products: Documenting income from sales of produce or livestock.

Paying bills: Recording expenses such as utilities, labor, or equipment maintenance.

Accounts payable: Paying money you owe to others for purchases made on credit.

Receiving loans: Documenting receiving bank loan proceeds and using those funds.

Paying off loans: Recording payment of principal and interest on a loan.

Accounting platforms that sync with your bank account often reduce the need for writing journal entries from scratch. But there are cases where recording a journal entry may be helpful or necessary. Here are a few examples:

Depreciation. When you buy or lease an asset, you generally can’t deduct the total purchase price immediately. Instead, you write off the cost of the asset over its useful life—a process known as depreciation. You need to keep fixed asset schedules or depreciation schedules to track accumulated depreciation on each asset. At the end of each accounting period, you post a journal entry to recognize the depreciation expense and the corresponding entry to accumulated depreciation on the balance sheet.

Summarizing sales or payroll data: If you work with an external point of sale system like Square, you may have multiple deposits that you want to categorize across a certain time period. If you would rather not tag each transaction manually, you can use a journal entry to group them together and use your sales data to tag them to the right category and enterprise.

Itemizing transactions across multiple accounts: Similarly, a journal entry could be useful if you may receive deposits for cash and check payments for the same services. These will come into your bank account and your cash on hand account. To be able to correctly categorize this income by what you sold, you may need to combine these deposits to be able to split out by product.

Year-end adjustments: During an end-of-year review by your accountant or bookkeeper, there may be adjustments that they want to make at once to account for errors that need to be balanced.

If you use the accrual method for accounting, there are additional cases where journal entries may need to be recorded. If you use accounting software with built-in invoicing or bill pay, the software will likely generate the necessary journal entries for common transactions like accrued revenues and accrued expenses. Here are some examples of journal entries in accrual accounting:

Accrued revenues. Accrued revenue is also known as accounts receivable. It’s revenue earned in one period but not received until a later accounting period. For example, if you sell $500 of products to a customer on credit in March but receive payment in April, you’ll have $500 of accounts receivable on your March 30 balance sheet.

Accrued expenses. Accrued expenses are costs you incur in the current accounting period but pay for in a later accounting period. For example, you use electricity in your operations every month but wait to pay your electric bill until you get the statement the following month. To ensure you match expenses to the correct accounting period, estimate your bill at the end of the year and record accrued utilities expenses. When you receive your power bill, you make a journal entry to reverse that accrual and record the actual expense amount.

Deferred revenues. Deferred revenues are amounts paid in advance by a customer. For example, say you contract to sell 10,000 bushels of corn for $50,000. Your customer pays in advance, but according to the contract terms, you deliver 5,000 bushels immediately and will deliver another 5,000 bushels in three months. You would record $25,000 in revenue now, and the other $25,000 would remain on the books in deferred revenue until you deliver (i.e., “earn”) the revenue in three months. When you deliver the remaining bushels, you make a journal entry to move that money from deferred revenues to the income statement.

Prepaid expenses. Prepaid expenses are costs you pay for in advance. For example, say you sign a contract to be a vendor at a local farmer’s market from May through October. You must pay a booth rental fee of $600 in advance, which covers the entire 6-month market season. When you sign the contract in March, you’ll have prepaid rent of $600. At the end of each month covered by the agreement, you make a journal entry to move $100 out of prepaid rent and into rent expense.

Creating Journal Entries

To make a journal entry, you need a few vital pieces of information:

Date of the transaction. In many cases, you might prepare journal entries on the transaction date. However, sometimes businesses need to record a journal entry to correct a previous accounting period. Using the correct date helps maintain chronological order in your books and is essential for accurate record-keeping.

Transaction amount. The transaction amount might be simple. For example, if you purchase $500 of office supplies, you’ll credit your cash account for $500 and debit office supplies expense for the same amount. However, some journal entries are more complicated. For example, if you’re making a payment on a bank loan, you need to know how much of that payment went toward the loan principal and how much went toward interest.

Affected accounts. Remember, each transaction impacts at least two accounts. For example, receiving cash due from a customer for a credit sale will increase your cash account and decrease accounts receivable.

Description. Each journal entry should briefly describe the transaction to provide context. For example, “Purchased feed for livestock.” These descriptions come in handy if you need to research a transaction later.

Simplify Your Journal Entries with Ambrook

Tracking journal entries is essential for managing the financial health of your operations, but recording and keeping track of all of these financial transactions can be time-consuming and complex if you don’t have the right accounting software.

Ambrook makes modern accounting software. With it, you can customize your chart of accounts, connect to your bank account to automatically record transactions, and get the insights you need to improve operations with organized financial statements and other helpful financial reports.

Schedule a demo today to find out how Ambrook can support sustainability and growth in your business.