The U.S. grows vast amounts of commodity soy every year, for animal feed and industrial uses. What about growing premium beans for plant-based burgers?

Soybeans have always been a part of Kyle Mehmen’s life. As he grew up on his family farm in Plainfield, Iowa, he watched multiple generations of soybean sprout from the soil and reach maturity, before eventually joining the business himself as a partner in 2005.

Alongside soybeans, Mehmen and his family grow corn — the two most common crops in terms of planted acreage in the U.S. Wanting to distinguish themselves in a crowded market, the family business has always been willing to dabble in an experiment or two. One strategy has been to grow higher value soybeans: those with properties like high protein or oil content.

“We’ve dipped our toe into higher value soybeans a couple of different times,” said Mehmen.

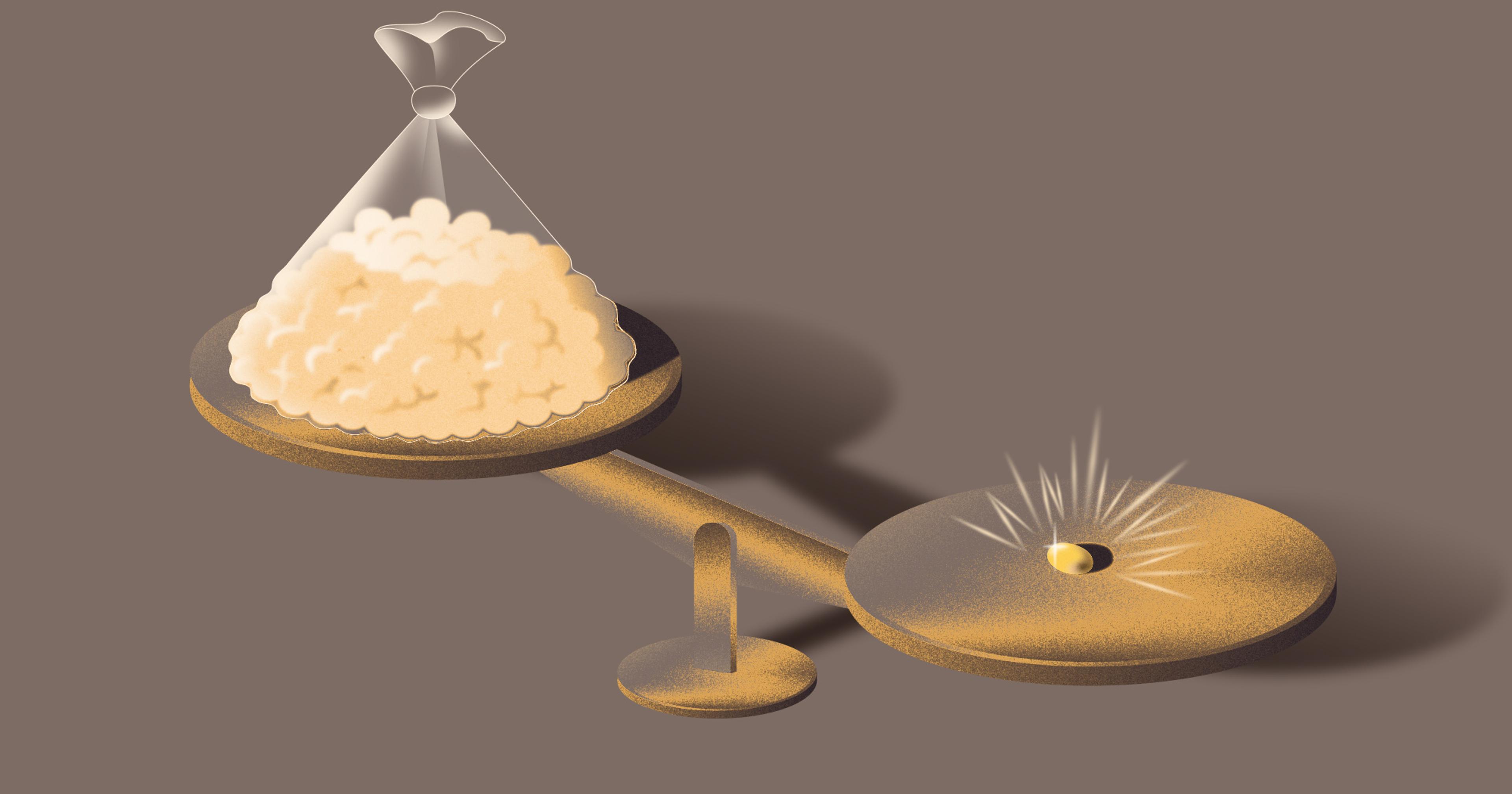

Typically, farmers are paid for the volume of a crop they produce per acre. With higher value soybeans, companies would offer a premium to incentivize farmers to grow them. Benson Hill, an agricultural genomics company, approached Mehmen in 2021, for example, and asked him to grow their non-GMO, ultra high-protein soybeans. In return, the protein content per acre would be factored into his earnings.

Mehmen said that means he doesn’t have to worry about producing the most bushels per acre. “What matters is that I have a quality product,” he added.

While the industry standard protein content for a soybean is at 40%, Benson Hill’s varieties go up to 48% — there’s a market for it.

Major advocacy groups, like the International Panel on Climate Change, stress the importance of moving towards plant-based foods and away from animal agriculture — a sector that is responsible for roughly 20 percent of global emissions and is the leading cause of habitat loss, among other issues.

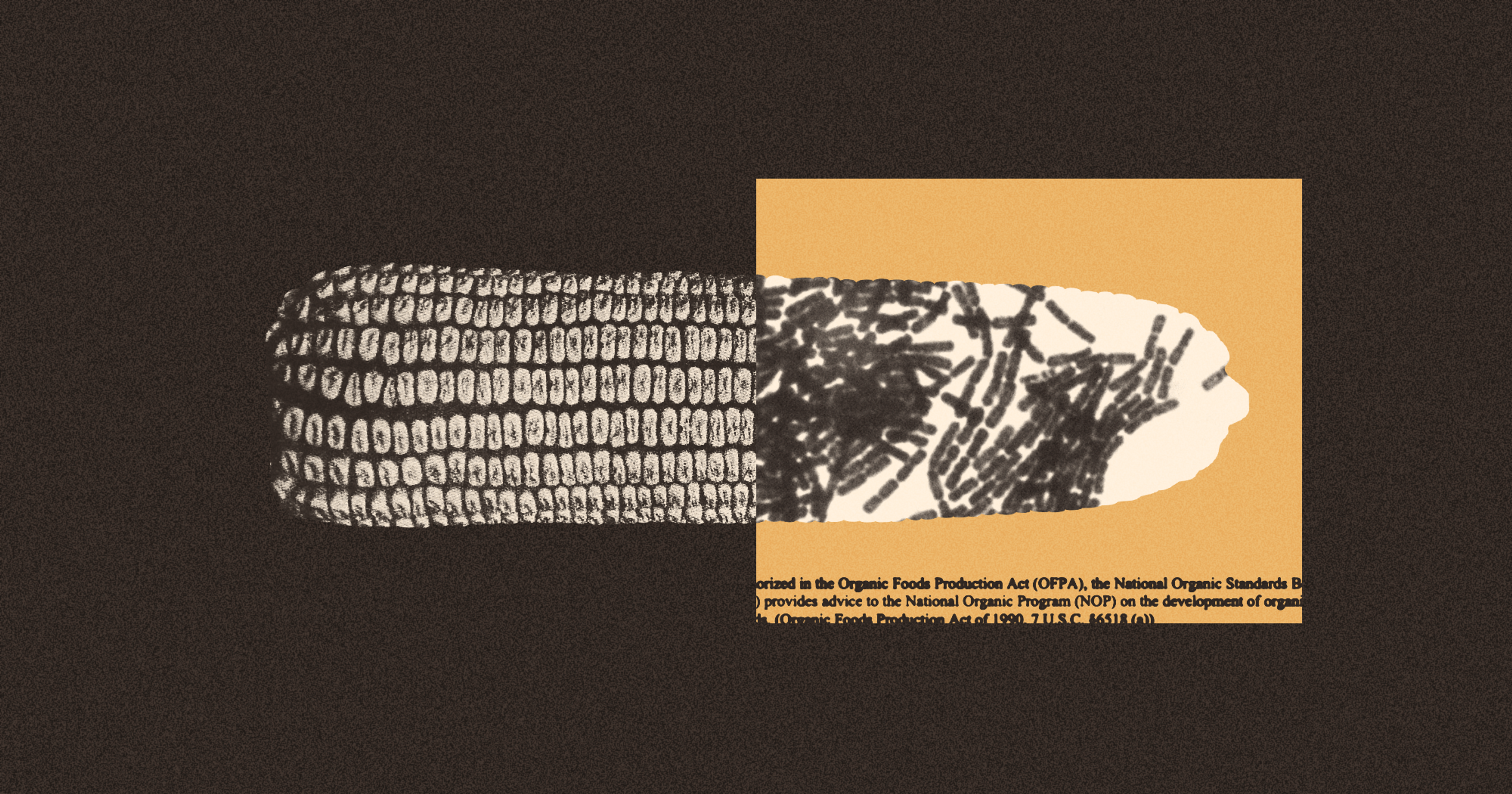

Some believe the key to that agricultural transition lies in plant-based meat alternatives. Over time, however, crops like soybeans have been bred to favor high yields to the detriment of properties like protein content. Many plant-based meat companies suggest this negatively impacts their taste profile; high-protein soybeans are an attempt to create a more appealing product.

It’s not just about protein or plant-based alternatives either. Corteva has developed soybeans with high oleic content, which, they say, have 20% less saturated fat than commodity soybeans, making them a healthier alternative. Research suggests soybeans could also be improved in other ways, such as by adjusting the amino acid profile of the bean.

“I give more care to these soybeans than I would to my regular soybeans because they’re higher value.”

Mehmen is just one of the many farmers currently working with Benson Hill across Iowa, Illinois, Indiana, and Missouri. Other companies, too, are involved in the quest to build better beans. Corteva pays a premium to farmers for growing higher oil soybeans, and ZealKal also works with farmers to grow higher protein soybeans.

With the premium offered for growing high-protein beans, Mehmen said that it became worthwhile to experiment with products like fertilizers. Though he didn’t give any specifics, he swears that he’s not protecting a “secret sauce” for growing the perfect soybean.

“I give more care to these soybeans than I would to my regular soybeans because they’re higher value,” said Mehmen.

Aside from the extra time tending to the sprouting beans, there’s also more bureaucracy involved in producing high-protein soybeans. On Mehmen’s farm, the paperwork requirements are so heavy that he hires somebody to work on that.

Joe Janzen, assistant professor in agricultural economics at University of Illinois Urbana-Champaign, explained that it has to do with the way commodity crops function. Commodity soybeans from different farms end up mixed together as there’s no real need to distinguish between them, and therefore a paper trail isn’t strictly necessary.

“If we want to preserve specific characteristics [like high protein content], we have to develop identity-preserved supply chains,” he said.

Janzen said that if companies or consumers want these higher protein soybeans, then the incentive structure devised by Benson Hill is likely the way to go.

“I think that’s the way that it has to be done,” said Janzen, “particularly if the production of those soybean varieties comes at a higher cost to the producer.”

“A lot of our soybeans were originally destined for the human food ingredient market, but that market simply didn’t materialize the way that everyone expected it to.”

Commodity soybeans are predominantly used by the agriculture industry as animal feed — most soybeans aren’t fed directly to humans. There are other industrial uses as well, such as in the production of rubbers, plastics, and adhesives. None of these products require a high-quality bean.

Nina Elkadi researches soybeans as a plant humanities fellow at Dumbarton Oaks, a Harvard University research facility. She thinks it’s well past time we started growing better soybeans for human consumption. “Most soybeans today are not turned into food we consume,” she said. “It’s time for a distinction between what we feed animals and what we feed ourselves.”

Some people, Janzen said, envision a food system which is based around producing higher quality crops, but he questions whether a market like that can truly scale. Cost, he believes, is the most important factor for consumers — one survey found that price “highly impacts” food choices for eight out of ten Americans. Growers and others along the supply chain are thus encouraged to favor quantity over quality.

If, for example, there were a range of enhanced soybeans — whether high-protein, oil, or something else — each would have its own paper trail and input requirements. The cost of this system would be offloaded to consumers, raising the prices of things like plant-based meat alternatives.

For his part, Mehmen thinks that high-protein soybean production is unlikely to ever dominate the U.S. market.

“Do I think that these kinds of programs can take over all 90 million acres of soybeans in America?” he said. “Absolutely not.”

“How is it feasible to grow a bean that needs a lot more care and attention, unless there are incentives?“

What’s more, he hopes they don’t either — Mehmen likes being able to distinguish himself with the extra work and transparency that comes with the program. If higher protein soybeans became the norm, they’d be a commodity crop.

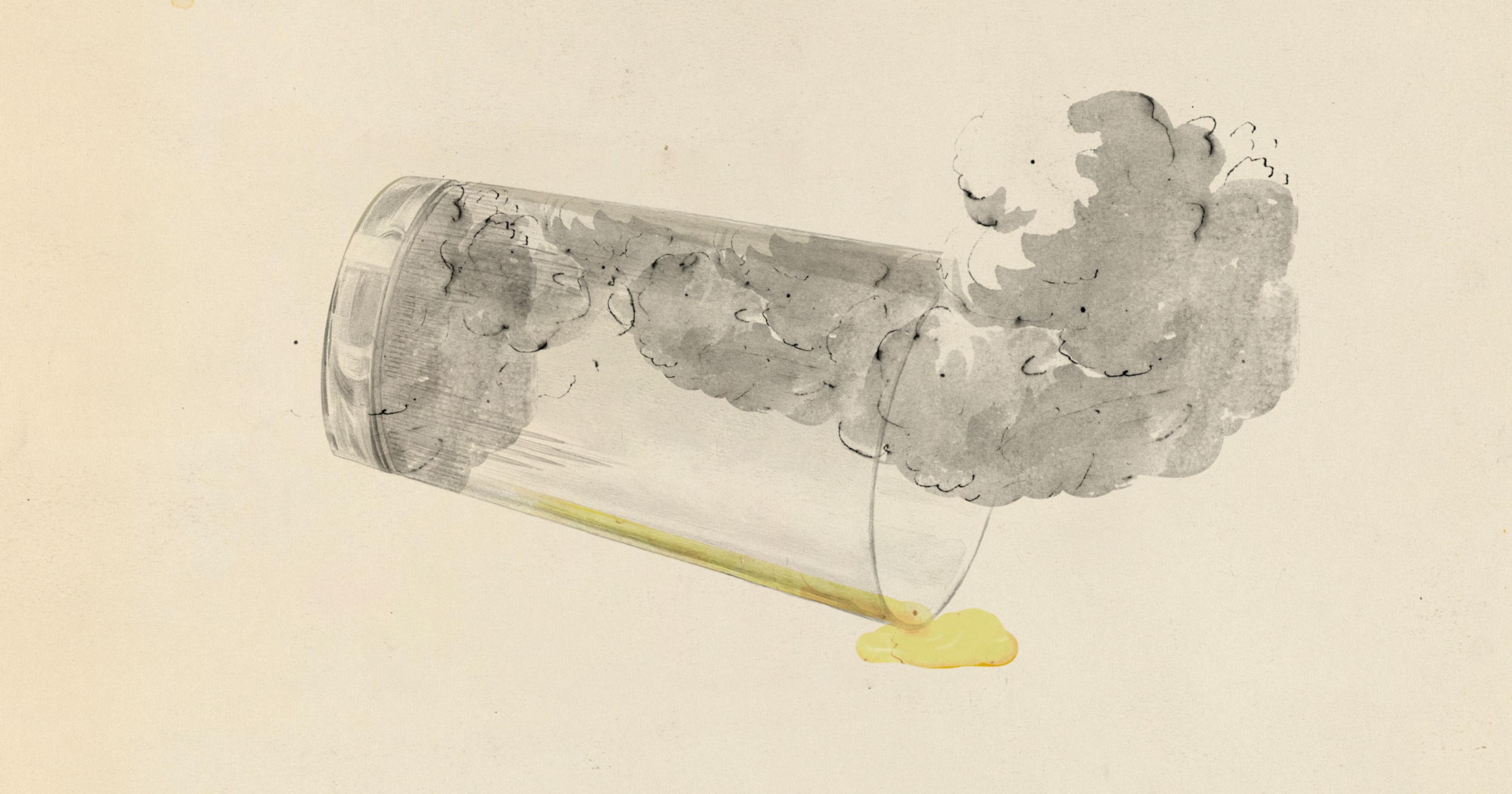

The market also suggests that it’s unlikely to happen any time soon. Although the amount of plant-based meat alternatives sold doubled from 2017 to 2020, in the following two years the market stagnated. A number of reasons have been suggested, from the failure to attract repeat customers to inflation pushing consumers to choose cheaper options.

Holly Wang, a professor in agricultural economics at Purdue University, said that her research has found that some consumers are willing to pay for food with environmental or health upsides.

“Many people are willing to pay more for public benefit,” she said, adding that it’s even the case where taste or nutrition are the same. For plant-based meat alternatives, the open question, she said, is whether the amount of people willing to do so justifies the production costs.

In Benson Hill’s case, the answer is no. They recently decided to change their business model to focus primarily on the animal feed market instead.

“A lot of our soybeans were originally destined for the human food ingredient market, but that market simply didn’t materialize the way that everyone expected it to,” said Christi Dixon, senior director of public relations at Benson Hill.

Although they primarily aim to have their soybeans in animal mouths across the country by 2030, part of their income will still come from the human food ingredient market. Starting in two years time, they will license out their high-protein soybeans to third parties rather than working directly with farmers. So, for example, a plant-based meat company could pay a fee to Benson Hill for use of a higher quality soybean and then contract a farmer to grow said soybean.

Not all hope is lost for the high-protein soybean market, and Mehmen hopes to remain a part of it. If a third party doesn’t choose to work with Mehmen, however, or if they don’t offer the right premium, he could end up losing the additional 20-30% revenue that the program brings. In that case it’s back to the drawing board, in the hopes that another company offers him a premium product he’s interested in growing.

“The fiscal component for farmers is key,” said soybean researcher Elkadi. “How is it feasible to grow a bean that needs a lot more care and attention, unless there are incentives?“