Cryptocurrency companies are attempting to use waste heat for greenhouse growing.

As you’ve likely heard, the production of Bitcoin requires an immense amount of energy, its annual terawatt consumption roughly equal to that of Australia. This energy usage in turn creates a lot of “waste heat,” which radiates off mining rigs and typically burns off into the ether. The endeavor to capture this wayward heat and direct it toward useful ends has developed into something of a cottage industry in the crypto sector: Use Bitcoin to warm your house, your pool, your greenhouse.

For many people, cryptocurrencies exist as a quintessential artifact of the digital age. A financial abstraction. A human contrivance. It’s hard to think of anything less organic, less biological, less living than a Bitcoin.

A garden-fresh tomato, on the other hand, is a basic unit of the natural world. Its warm red flesh — sometimes purple, sometimes yellow-green — feels self-evidently full of life in your palm. We all know what a tomato is.

But for some Bitcoin miners, this seeming incompatibility between agriculture and the world of crypto is actually an opportunity for symbiosis.

“Bitcoin Capitalist,” an enthusiast on TikTok, visited one of these greenhouses this past January. Bundled into a thick coat, he panned the camera around to show tomatoes and basil growing resolutely against the winter’s odds. “This is the future of Bitcoin mining,” he announced, his voice just loud enough to compete with the relentless buzz of computers in the background, a stack of them affixed to the inside of the greenhouse wall.

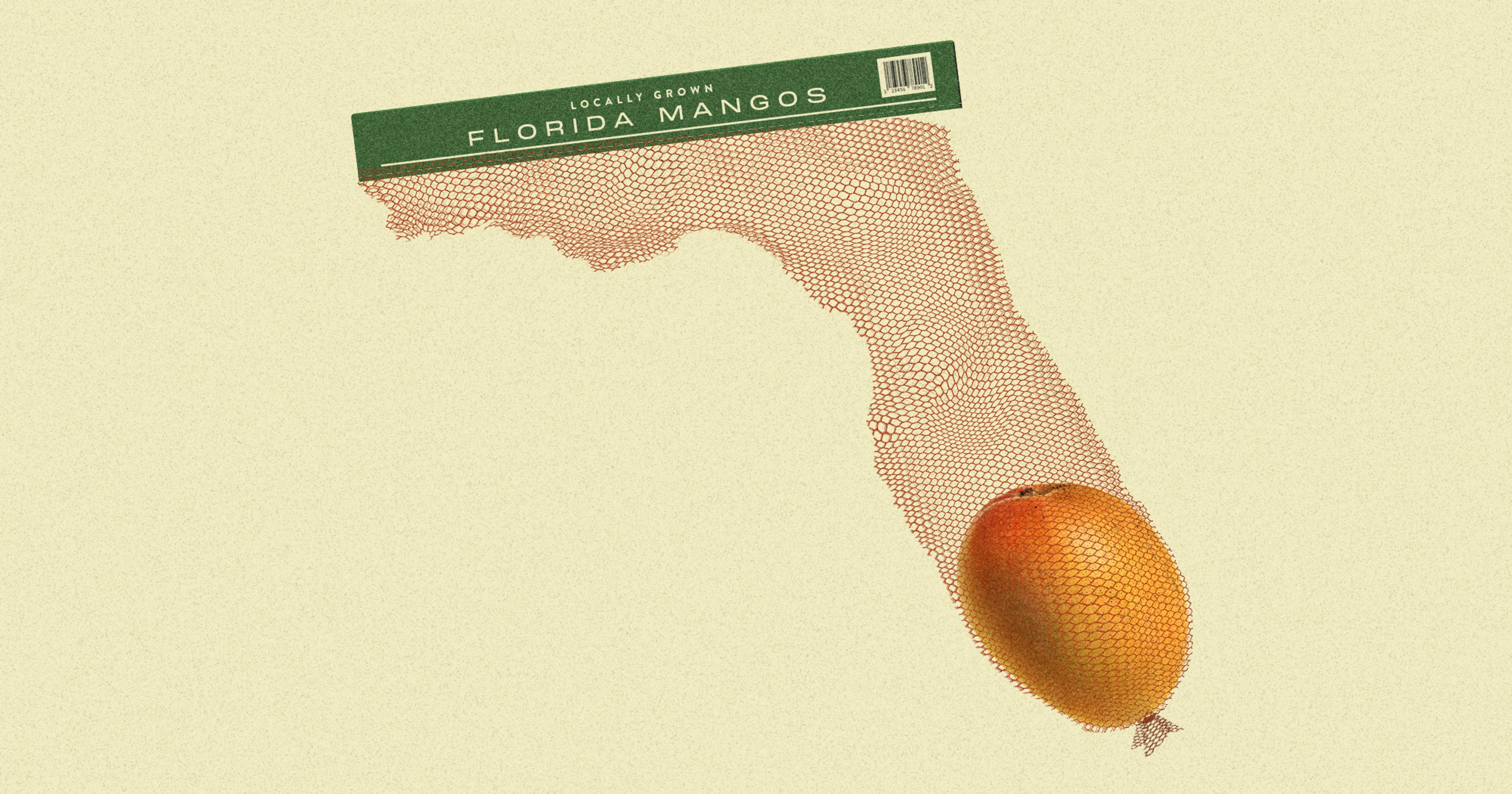

In addition to tomatoes and basil, the gardeners here have also planted parsley, sage, and peppers. The greenhouse is on the campus of the Bitcoin company Merkle Standard, located in eastern Washington state. With the help of a Chinese hardware manufacturer and an American investment conglomerate, the firm outbid the local Kalispel Tribe to take over the former site of the Ponderay Newsprint Mill in 2022. The cryptocurrency operation has replaced the industrial output of paper with a less tangible — but potentially more lucrative — product for the 21st century.

While crypto has seen a recent downturn in profits, the biggest mining enterprises in the business are generally still doing well, taking advantage of cheap energy rates offered to large-scale buyers. In Washington, dammed rivers provide abundant hydropower, making for especially low electricity bills.

Perhaps self-conscious of the mixed public opinion on crypto’s environmental record, Merkle Standard’s website pledges its commitment to “building North America’s largest sustainable digital asset mining platform.” Laura Verity, the company’s director of external affairs and environmental manager, was quick to acknowledge in an interview that there is “a lot of really negative press and understanding of the data center operations around digital assets.” She hopes that Merkle Standard can be “the shining star example of how to do it right.”

In addition to traditional green business practices like prioritizing renewable energy, the company’s heat recapture efforts indicate an interest in pushing the envelope into more experimental territory. The blueprint for using Bitcoin rigs as the heat source for greenhouse production is close to nonexistent, at least in this country. The practice has gained a bit more traction in Europe and Asia. In the Netherlands, a tulip farmer is warming her grow space in part with the help of crypto miners.

“The miner is a guest in the greenhouse, it has a completely different objective.”

(Perhaps she was inspired to prove mathematician-philosopher Nassim Taleb wrong on two accounts, who disfavorably compared Bitcoin to the 17th century “tulip bubble.”)

For some, the dearth of Bitcoin-heated greenhouses is indicative of a fundamental impracticality in the whole idea. Or rather, a series of impracticalities. Alex de Vries, founder of the Bitcoin Energy Consumption Index, pointed out very simply that “these machines are not made to be heaters.” These are computers manufactured to perform exclusively one task.

Besides the passive work of the sun, the most common energy inputs for greenhouse heating are fossil fuels. The heaters are precisely calibrated with a thermostat, which keeps the structure from getting too hot or too cold. This finely tuned automation is a vital cost-saver for an industry with famously thin margins (propane is too expensive to burn up carelessly). It’s also necessary for sustaining the optimal temperature range in a greenhouse, which is typically a grow space designated for fussy high-value crops that can “earn their rent.”

If a farmer replaces a standard greenhouse heater with a Bitcoin mining rig, they are introducing a piece of equipment that is never supposed to be unplugged. Stacy Stang, business development supervisor at Merkle Standard, explained, “It’s not like a propane heater that you just go over and shut off. You need to still have the revenue from the miners running.” While greenhouse crops generally thrive in warm environments, running heaters on a hot day can quickly lead to wilting and crisped plants.

“It’s not like a propane heater that you just go over and shut off. You need to still have the revenue from the miners running.”

Merkle Standard is first and foremost a digital asset mining company. The agricultural demands coming from its experimental greenhouse are necessarily secondary. As DeVries put it, “The miner is a guest in the greenhouse, it has a completely different objective.” A thermostat signal telling the computers to, even temporarily, pause their life’s mission would run counter to the profit requirements of the whole enterprise.

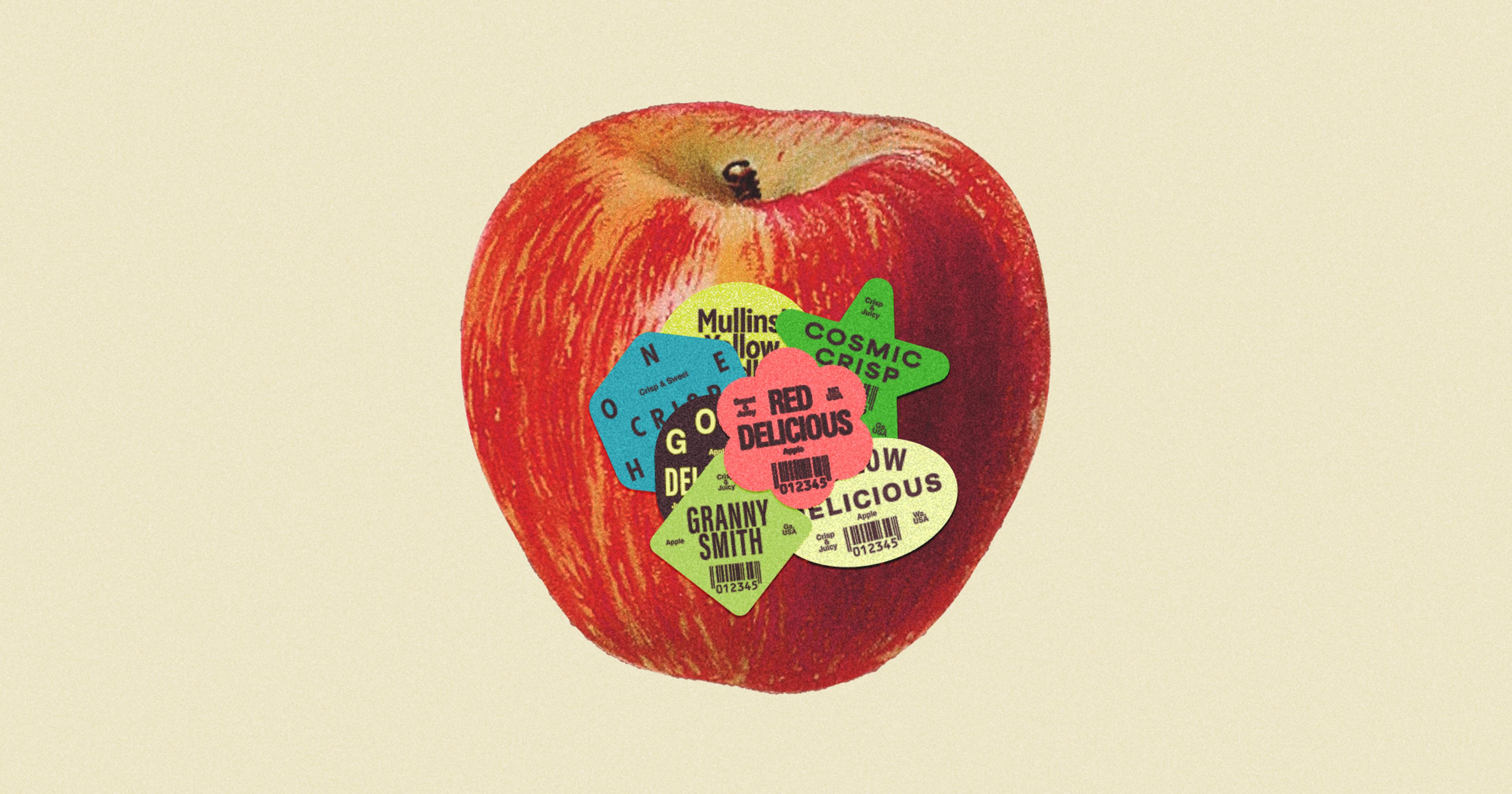

Further complicating the promise of miner-heaters is the increasingly short lifespans of the rigs. In an ironic flourish, as Bitcoin computers become more energy-efficient with every new generation, models are passing into obsolescence at a quicker rate. This constant race to upgrade mining rigs with cost-saving machines (energy is money), contributes to a growing pile of electronic waste associated with the industry.

With proper maintenance, a farmer can reasonably expect traditional greenhouse heaters to last well over a decade. De Vries’ research estimates that a Bitcoin rig’s mileage averages only a year and a half. This is a short window of time to earn one’s money back after dropping thousands of dollars. You are going to want that thing firing on all cylinders (until it inevitably ends up in the trash heap).

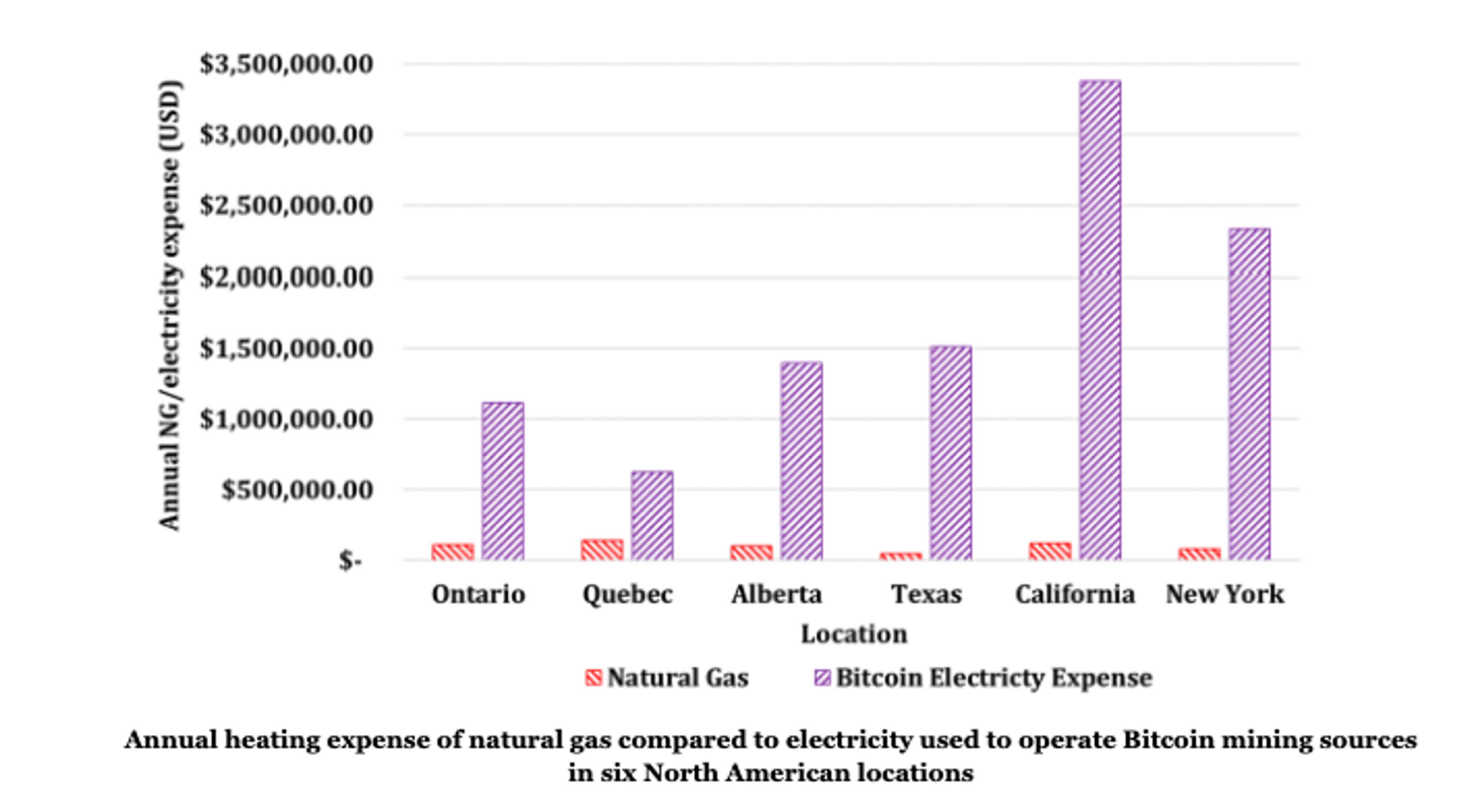

Last year, a study out of The University of Western Ontario considered the hypothetical application of Bitcoin waste heat in greenhouses. It found wide disparities in feasibility between sites. In Quebec, where the price for electricity is relatively low, a grower could potentially see some profits from substituting out fossil fuels with electric-powered crypto heat (assuming it’s a profitable year for Bitcoin). In California, where electricity is significantly more expensive than Quebec’s supply, the operation is almost certain to run a deficit. Even in a good year for Bitcoin valuation, it is unlikely that the revenue would justify the electric bill.

With the ag sector already riddled with economic volatilities, it seems doubtful that many growers will be looking to swap out propane for crypto heat. More likely, any movement that we do see in this space will be from large digital asset companies like Merkle Standard, who are better positioned to absorb the risks of fluctuating cryptocurrency markets (and pay a premium for energy). For them, the Bitcoin miners are already a fixed investment. Why not use the waste heat to grow a crop of tomatoes?

Going beyond financial considerations, there are simple hardware concerns with the computer-heater model that could make it unattractive to a farmer whose primary objective is growing produce.

As hot as these rigs burn, in cold climates (like Quebec), the waste heat will not always be sufficient to keep the crops alive and healthy — the Dutch tulip grower (who is partnered with the cryptocurrency company Bitcoin Brabant) still relies on some natural gas. This means a miner-farmer has to keep their traditional heating infrastructure in place, with all of the costs associated with its upkeep.

And while a propane heater isn’t the quietest piece of equipment on the farm, once it gets past the initial clanging rattles of firing up, it settles into the background. It pales in comparison to the noise that ceaselessly emanates from the miners, which is only magnified by a greenhouse’s echoing acoustics. Changing out the old heater for a newer, louder, more costly, and less efficient one might be a hard sell for the average bootstrapped farmer.

All told, the marriage between Bitcoin and indoor growing is perhaps better understood as a development in the cryptocurrency space than as a sign of the future in how we farm.