As EVs climb in popularity, electric tractors lag behind. But so do the incentives to purchase them.

The electric vehicle market has seen explosive growth over the past decade. In 2014, a mere 63,525 plug-in electric vehicles were sold in the U.S. By 2024, sales skyrocketed to 1.2 million. Yet the same trends haven’t hit the electric tractor market, which continues to lag far behind the rest of the sector.

A 2022 report from California nonprofit CALSTART suggested that only well-off farmers with strong convictions about climate change were likely to purchase electric agricultural equipment, given the higher up-front cost and the need to invest thousands in charging stations. The infrastructure needed to charge electric agricultural vehicles can cost up to $50,000, and the CALSTART report noted that electric tractors are about 20% more expensive than their diesel counterparts; savings incurred by using electricity instead of fuel can take time to pay off.

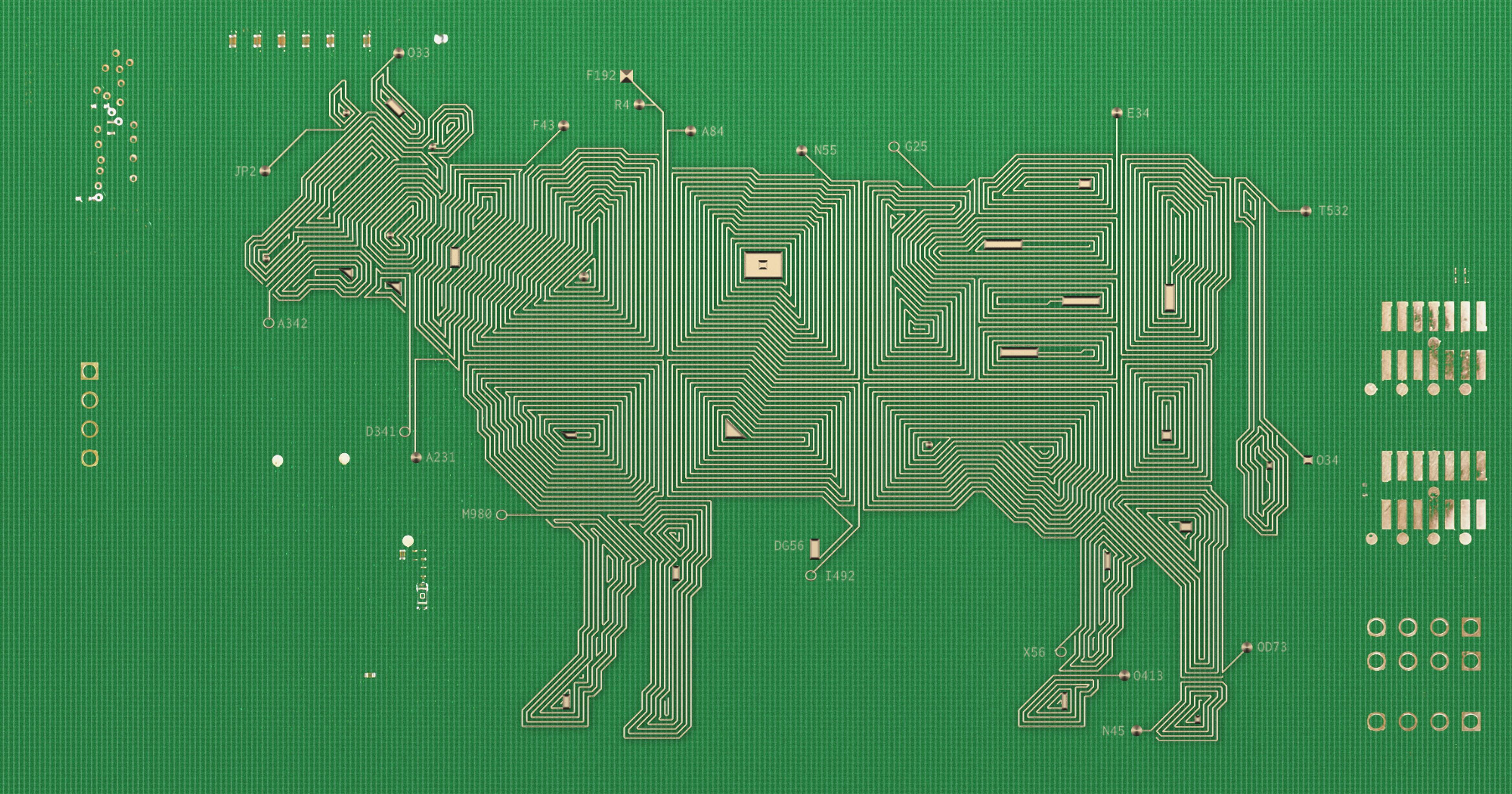

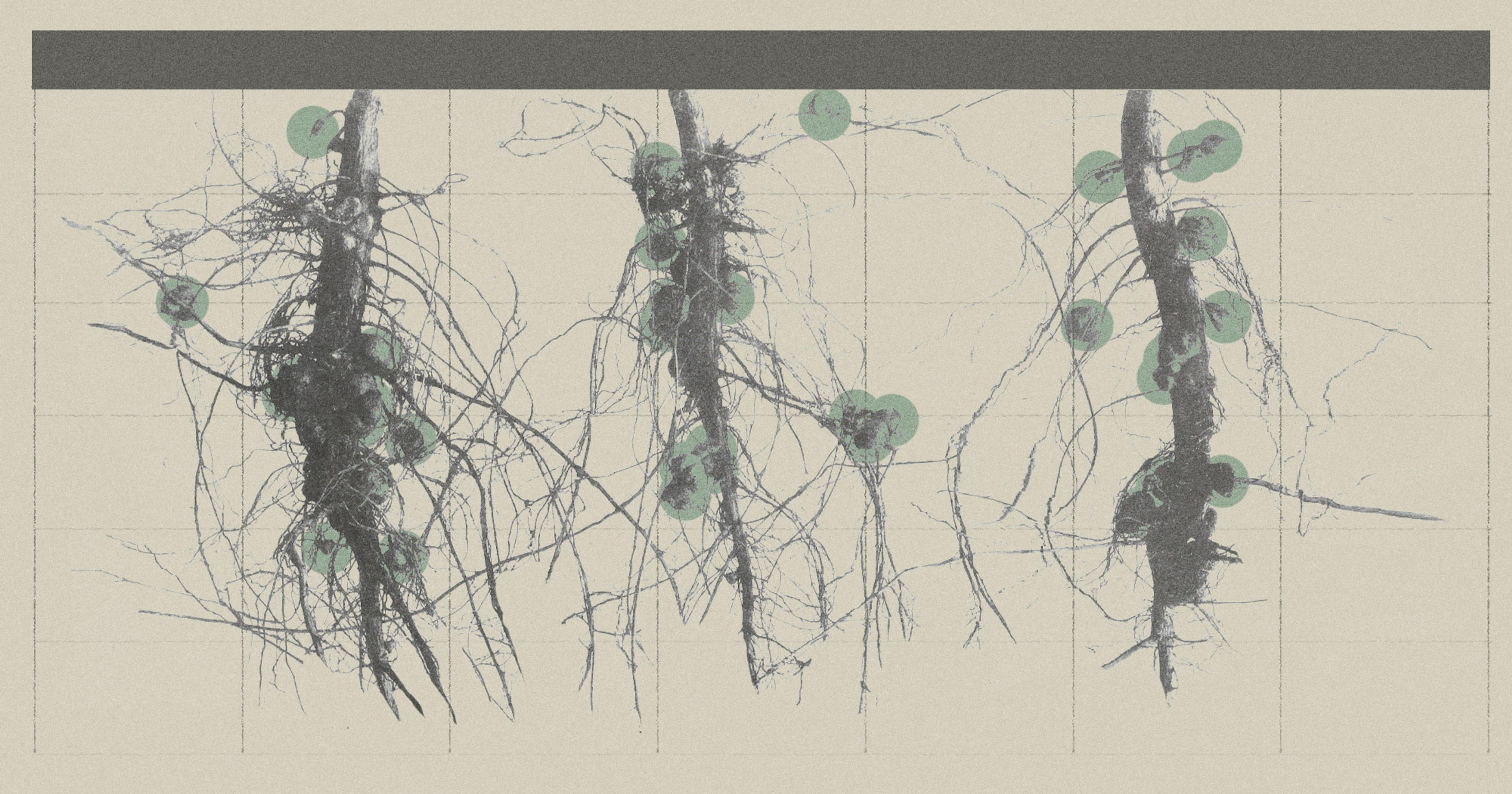

Other issues inhibiting electric tractor growth include concerns about soil health and a lack of available tax credits. Behemoth tractors are already weighty vehicles, and the heavy batteries required to run large machines would add significant weight — this poses the risk of damaging soil. And while financial incentives like the clean vehicle tax credit are available for on-road electric vehicles, not many incentives are available for farmers. No federal credit exists for electric tractors, and California is the only state that offers a voucher through its Clean Off-Road Equipment Voucher Incentive Project (CORE) program.

Monarch Tractor, an electric tractor startup in California, makes the only approved model for the CORE program. Their tractor sells for $90,000 and boasts autonomous driving features; CORE vouchers knock $55,000 off the sticker price. But despite the vouchers, and despite raising $133 million in July 2024, Monarch laid off 10% of its workforce last November.

Monarch’s struggles are reflective of the overall electric market: The U.S. electric tractor market was worth just $200 million at the beginning of 2025. By comparison, the overall U.S. tractor market was worth $23.7 billion at the same time.

While the electric tractor market at large hasn’t gone according to plan, some farmers have turned to custom electric solutions.

Ted Blomgren runs Windflower Farm, a 30-acre organic farm in New York’s Hudson Valley. When Blomgren attempted to convert his Allis Chalmers G tractor to electric in 2000, it was mostly a passion project to work on with his two sons, 8 and 5 at the time. But what was intended as a father-son bonding project turned into a years-long fascination with electric tractors.

The G tractor conversion wasn’t the ideal fit for Blomgren’s farm — he needed a tractor with a three-point hitch, and wanted to carry more tooling implements at a time — so he set out to design his own electric tractor from scratch. Blomgren took inspiration from an Italian-made Mazzatti tractor, and its ability to carry three tooling implements at a time, reducing the number of passes through his crops. His tractor build worked well; he’s now built three of them for his farm.

And while financial incentives like the clean vehicle tax credit are available for on-road electric vehicles, not many incentives are available for farmers.

Blomgren has toyed with the idea of taking his invention to production, but he wants to fine tune a few features first. ”We’re building so many pieces from scratch, it’s kind of a fun challenge. We built our own brake pedals and brake boxes,” he said.

Despite innovators like Blomgren, Steve Heckeroth thinks farmers can be slow to adopt new inventions. “Farmers are a pretty conservative bunch to begin with. They don’t like change, and there’s so much change happening now,” said Heckeroth, CEO of Renewables. Renewables is a startup building a two-wheeled electric tractor for small farms. The tractor is still in the prototype stages, but Heckeroth hopes to bring the tractor to production by partnering with an autonomous vehicle company.

Heckeroth’s former company, Solectrac, which he founded in 2012, produced larger four-wheeled electric tractors. Solectrac — along with its parent company, Ideanomics — filed for bankruptcy in 2024. Heckeroth believes that the strategy to sell Solectrac tractors through a network of diesel tractor dealerships was a big mistake.

Heckeroth claims the company “spent millions and millions on advertising to people who thought it was a communist plot. Even some of the dealers got death threats when they put the electric tractor on their lot.” Heckeroth added that Solectrac “moved too fast” in their attempts to expand, which ultimately doomed the company.

A salesman at Beeler Tractor in California told me he previously had one Solectrac tractor on his lot, but it took over a year to sell. At another Beeler tractor location in Yuba City, California, sales representative Casey Dihel told me that “a lot of people weren’t open to the idea of an electric tractor, mostly due to run time.” He added that most Solectrac tractors he sold went to hobby farmers — commercial farmers weren’t interested. Two Solectrac tractors remain on his lot, which he received prior to the company filing for bankruptcy.

“ Our pitch to farmers is seven to $12 an hour. For every hour you run a tractor, that’s the savings that you see just on diesel versus electric.”

A YouTuber who goes by Tractor Time with Tim posted several videos on the Solectrac tractor he purchased. He praised the power of the electric motor, but was disappointed in the battery, which drained after a mere two hours.

Short battery life has long been a recurring critique of electric vehicles — both tractors and automobiles — but Blomgren says his invention can run for about six hours. “ Six hours is kind of a sweet spot,” he said. ”Nobody wants to be out cultivating for too many more hours than that.”

In a 2023 Pew Research survey, researchers found that younger respondents were more likely to consider purchasing an electric vehicle. That said, only 24% of rural respondents were open to the idea, in comparison to 48% of their urban counterparts.

Tepid responses to electric tractors aren’t stopping other manufacturers from dipping their toes in the market, though. Tilmor — an Ohio based startup — is slated to release a small electric tractor in fall 2025, and John Deere plans to release several electric models in 2026.

And despite the challenges, many remain optimistic about the future for electric tractors, including Kofi Britwum, an agricultural economist at the University of Delaware. ”The market is really going to grow,” he said. ”As much as 29% within the next nine years or so, so there’s definitely some promise.”

Monarch thinks the best selling point for skeptical farmers will be cost reduction — after the initial investment. Monarch CEO Praveen Penmetsa noted that the operating costs per hour are much lower than diesel tractors. “ Farming is a very low-margin business,” he said. “ Our pitch to farmers is seven to $12 an hour. For every hour you run a tractor, that’s the savings that you see just on diesel versus electric.”