Trimming rail staff and service in the name of profit is leaving poultry producers in a lurch.

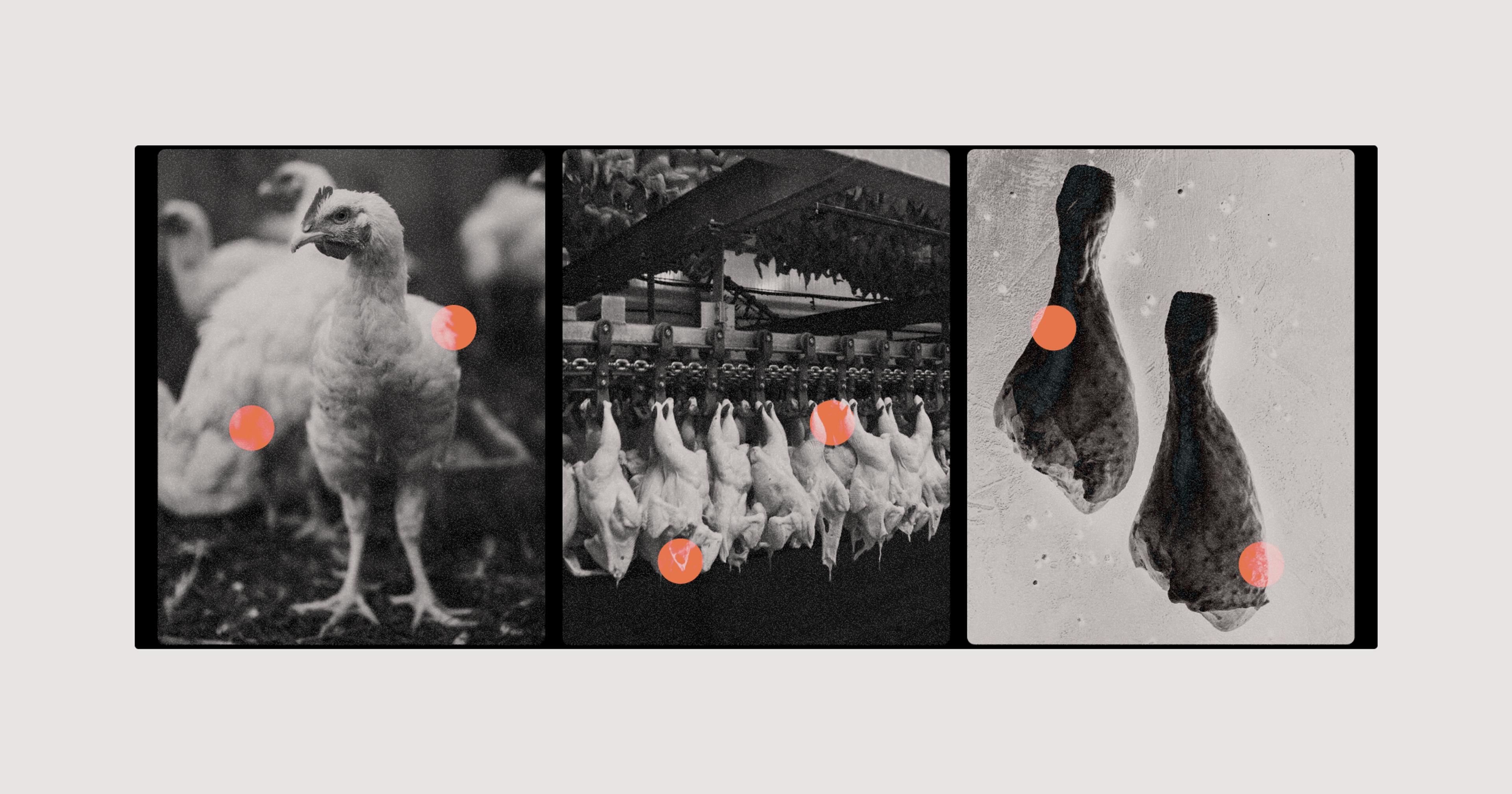

While Americans watched the price of eggs skyrocket, another chicken drama has been playing out in the background. In December, Foster Farms, the largest chicken grower in the Western U.S., which processes roughly 1 million chickens and 12,000 turkeys a day, warned that millions of birds would starve if their shipments of grain feed were not delivered by Union Pacific Corp. as soon as possible.

This game of supply chain chicken would end up stretching well into January.

Foster Farms accused the rail company of “service failures” dating back to February 2022, according to a letter they sent to the U.S. Surface Transportation Board (STB). Union Pacific, the second-largest railroad in North America, blamed the weather. But Foster Farms had also called on STB to intervene back in June over the same problem.

Foster Farms said they needed help — they were running out of feed and time. On December 30, STB stepped in again, ordering Union Pacific to make the delivery, which they did on January 14. A spokesperson from STB said this kind of intervention is incredibly rare — though it should be noted it happened twice within a year — but they will do so again if they have to.

Disaster averted, but all is not copacetic. Rail’s problems are not over, as they continue to work through a pandemic-related backlog exacerbated by years of cost-cutting measures that put profit over reliable service. While grain can be moved by barge and truck, there isn’t enough capacity — nor is it cost-effective — to cut rail out of the transportation picture.

“Rail is a very efficient way to move a lot of stuff a long distance, and it’s irreplicable,” said Richard Rushforth, assistant research professor in the School of Informatics, Computing, and Cyber Systems at Northern Arizona University.

Fixing this irreplaceable part of how food and food for food moves is urgent. The domestic $46.1 billion poultry industry depends on it.

In an emailed statement, Foster Farms wrote, “We have a long working relationship with Union Pacific, and it is our hope that more reliable service standards can be maintained, and further disruptions minimized. Foster Farms appreciates the consideration of the Surface Transportation Board and its ongoing monitoring of grain shipments.”

Union Pacific did not reply to a request for comment.

Moving Grain by Train

It’s easy to think that the country’s food supply chain runs on tractor trailers. They’re easy to spot on the highway, and in supermarket parking lots and delivery bays.

But rail is “the backbone” of our nation’s food system, said Rushforth. “Moving food the last mile of the food chain is very truck-dependent … but grains and commodity crops and inputs into agriculture, like fertilizer, move by train.” While perishable foods for humans often move by truck, grains and crops are still train-reliant.

There’s just too much of it to be moved any other way, as commodity crops support a massive domestic and global product. The value of the U.S. poultry industry alone — which includes broiler chickens, eggs, and turkeys — was $46.1 billion in 2021, up 31% from 2020, according to the USDA.

This isn’t just to meet domestic demand, either. The U.S. is the second-largest poultry exporter in the world, accounting for about a quarter of the world’s poultry exports, according to the USDA. The agency credits the availability of domestic feed sources like soybean meal and chicken meal as giving the U.S. a competitive international advantage.

One typical freight train can carry about the same load as 525 trucks.

And movement of those domestic feed sources — for chickens but also other kinds of livestock — requires rail. Railroads transport about 750,000 carloads of grain-related products a year, according to the Association of American Railroads (AAR), including 400,000 carloads of grain mill products, like corn syrup, flour, and animal feed, and 260,000 carloads of processed soybeans.

There is no reliable backup when rail service falters, said Bobby J. Martens, associate professor of economics and Iowa Institute for Cooperatives Endowed professor of economics at Iowa State University. One typical freight train can carry about the same load as 525 trucks, he said.

“We already don’t have enough trucking capacity” in the U.S., he said. “To be able to think we could put it on a truck and service a major buyer is really not realistic.”

It’s not just a capacity problem either, added Rushforth. Railroads are also three to four times more fuel-efficient than trucks on a ton-mile basis, according to AAR, and can move one ton of freight about 500 miles on one gallon of fuel.

Precision Railroading Bites Back

Rail travel has faced the same problems as other modes of transportation during the pandemic, including unstable global supply chains, a tight labor market that’s made it difficult to fill empty jobs, and more frequent and extreme weather events.

But railroads also found themselves in a precarious position before Covid emerged, said Christopher Fagan, partner in Moore Colson, a tax and consulting firm that works with mid-market and Fortune 500 companies.

“If you look at the overall economy in the last 15 to 20 years, certain industries were very sexy to invest in,” he said, like the technology, healthcare, and social media sectors. In comparison, what he called blue collar industries, like railroads and manufacturing, were left behind.

“We need railroad in agriculture. We don’t operate without it.”

Railroads weren’t able to raise capital, even though they had a positive cash flow. So they tried to make themselves an equally attractive investment by implementing “precision scheduling railroading.” That meant cutting the size of the workforce (in part by not replacing retirees, Martens said), but also reducing the numbers of trains on the rails.

“They’re trying to move shipments en masse with one 100-car train as opposed to shipping a 15-car train just to get someone product,” said Fagan. It makes sense, from an efficiency perspective. But that also means those 15-car trains aren’t there to pick up the slack — or deliver something like chicken feed to one enormous processor.

When Covid hit, precision scheduling failed to meet the moment. The pandemic-related economic shutdown created a backlog that still hasn’t been worked through. “When you’ve cut head counts and you’ve got congestion at ports, that takes months and months to recover from,” said Fagan.

Laying Track for the Future

Getting American rail back up to speed to keep American poultry and livestock suppliers stocked with food and feed is not going to be easy. Despite Foster Farms ultimately getting its latest batch of feed, pressures on railroads have not waned. Part of Union Pacific California’s line between San Francisco and Los Angeles shut down mid-January due to an unstable bridge. The company also imposed an embargo on rail travel in four Midwestern states due to weather. They tried to test run a train with a one-person crew, but that move that was halted over safety concerns.

Hiring and training new railroad workers also takes time, said Martens. “You don’t just put someone in the engine of a train.” Labor strife doesn’t help make railroad jobs look attractive either. In December, Congress imposed a new contract on railroad workers to prevent a strike, which kept trains running but angered railroad unions.

But rail CEOs may be getting the message, Martens said, adding that he was encouraged by a January speech by Alan Shaw, CEO of Norfolk Southern, another Class I railroad. In essence, Shaw admitted they’d messed up. “A company can’t expect to provide sustainable growth if it provides its customers with lousy service products every three years,” Shaw said, according to Trains, and added that they’d no longer be furloughing crews and tightening spending during downturns, and would continue to focus on recruitment and hiring. After the speech, Norfolk Southern’s stock price rose (though it has subsequently dropped again).

Moving away from some of the cuts made by precision scheduling will make a difference, said Fagan, to getting service — including to American poultry and livestock growers — back on track. Imports are slowing at the moment, which will help rail companies continue to move through that backlog.

Keeping the status quo isn’t an option, or situations like what Foster Farms faced will keep cropping up, and may not be solvable by a government order. “We need railroad in agriculture. We don’t operate without it,” Martens said.