Swiss researchers have found a way to transform chicken feather waste into clean energy, but upending established industrial practices may prove difficult in the U.S.

“I’ve been constantly trying to understand how protein from food waste can be revalued and repurposed,” Raffaele Mezzenga, a trained physicist, said on a recent video call. He played quietly with a yo-yo in his brightly lit Zurich office as we spoke.

Mezzenga has spent 15 years of his nearly 30-year career exploring how to turn worldwide food waste into viable, upcycled products. Together with his team at ETH Zurich, a public research university in Switzerland, he has discovered ways to use dairy waste in water purification systems and to turn discarded protein waste into biodegradable plastics. More recently, his team had a breakthrough discovery, creating clean hydrogen fuel cells out of chicken feather waste.

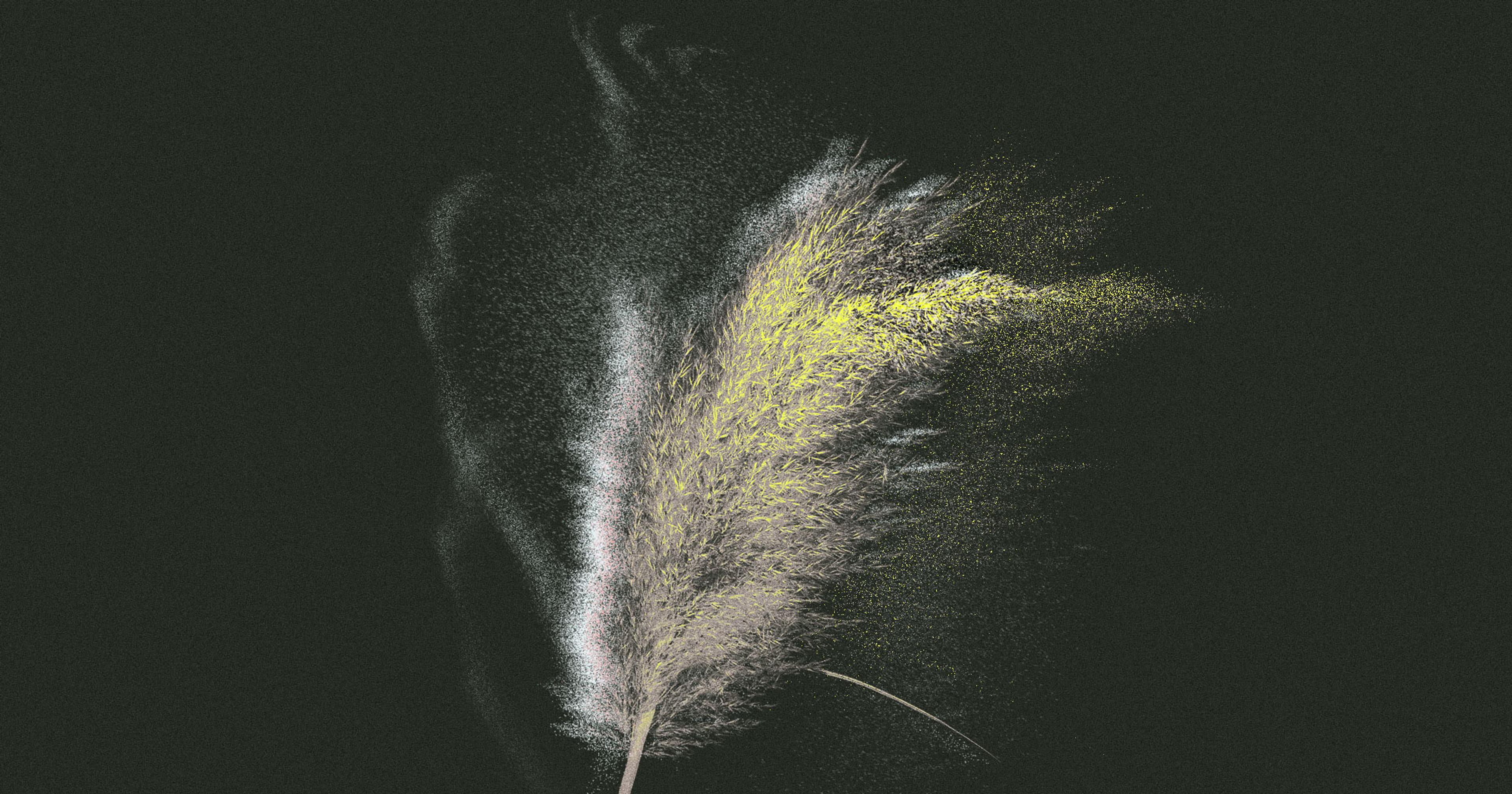

Chicken feathers are made up of 90 percent keratin, a fibrous protein also found in hair, hooves, and horns. They are considered a byproduct of the poultry industry and, unlike goose or duck down, lack the necessary fluff and length to stuff pillows and jackets. Globally, an estimated 40 million tonnes of chicken feathers are incinerated each year, which contributes sulfuric dioxide into the atmosphere — an indirect greenhouse gas. The U.S. alone creates 50 million tons of chicken feather waste annually.

Traditional hydrogen fuel cell membranes are both toxic and expensive, made from perfluorinated compounds (PFCs), which share common features with controversial polyfluorinated substances (PFAS), also known as forever chemicals. These membranes can cost upwards of $2,000 per square meter, said Mezzenga.

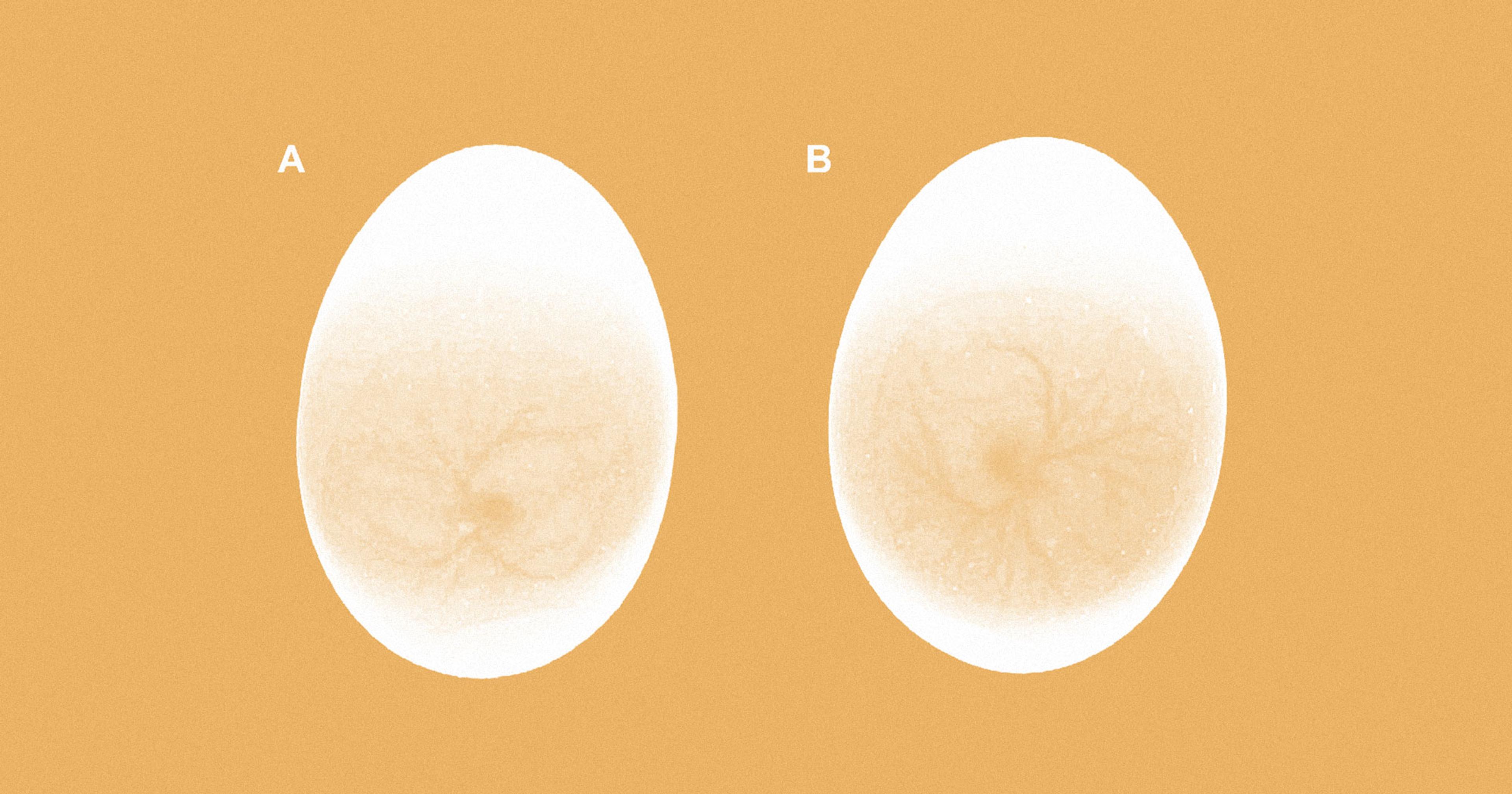

Using their collective knowledge of protein science, Mezzenga and his team extracted keratin from the chicken feathers and transformed it into an ultra-thin membrane that conducts protons. This membrane can then be used as an electrolyte in fuel cells, which produces clean, green energy when combined with hydrogen and oxygen.

The Zurich membrane starts as natural waste, making it more readily available and cheaper to produce in the lab than current synthetic membranes. It’s also biodegradable, solving the problem of disposal and potential environmental contamination. Mezzenga claims their technology “closes a cycle.”

Potential use cases for hydrogen fuel cells are narrow but growing. Today, they are mostly used in oil refining and steel production, but there is deep interest in adopting the cells for power grids and electric vehicles. The biggest obstacle for adoption is lack of infrastructure and cost — so far, only around 16,000 hydrogen cars are being driven in the U.S. Mezzenga hopes that his research will help make fuel cells more affordable, and widely available. For now, his membrane is only a few centimeters wide, and has been used to power an LED lamp, spin a fan, and move a toy car.

“We turn a disadvantage into an opportunity, basically.”

Creating energy from a farmed waste product might not seem like a comprehensive solution to the ongoing energy crisis, but Mezzenga’s feelings are measured. “The biomass [from chicken feathers] already exists,” he said. “We turn a disadvantage into an opportunity, basically.”

Research into recycled chicken feathers and their applications has been present in the U.S. for decades, and has resulted in all kinds of products, from polyester to circuit boards, even diapers. However, applications in the U.S. have all but stagnated.

Justin Barone worked as a research chemist at the United States Department of Agriculture (USDA) in the early 2000s, where he focused on finding new uses for agricultural waste, including chicken feathers. At that time, the U.S. had an estimated 4 billion pounds of chicken feather waste annually, and USDA was looking for innovative ways to repurpose them.

Barone and his collaborator, Walter Schmidt, worked on developing methods to create biodegradable plastics from chicken feathers. They made plastics, air filters, car parts, flower pots, and more. They even sought and won a patent for their technology, leading Barone to open Eastern Bioplastics, a poultry feather bioplastic company, in 2008.

Yet today, none of these applications are widely used, and Eastern Bioplastics has shut its doors for good. Barone said it is not from a lack of interest. “The industry has always been interested,” he said, but added that chicken feather technology, while promising, faced challenges competing against petroleum-based options already on the market.

The challenge lies in basic logistics and infrastructure, said Barone. The current systems and facilities are set up to convert fossil fuels, not feathers. “So, for us to come in and say we’re going to use poultry feathers instead of that, it was really difficult,” he explained.

Chicken feather technology has long faced challenges competing against petroleum-based options already on the market.

Sourcing feathers was equally challenging. In the U.S., most chicken feather waste is sold off to rendering plants, which process it into products like pet food and fertilizer. “They have a market,” he said. “It’s just a very low-value market, and it was difficult trying to compete with that.”

Mezzenga and his team have focused their sourcing efforts on Singapore, which discarded more than 7 tonnes of chicken waste daily. They also plan to look further into Asia and South America as they scale up their operations.

We attempted to reach some of America’s largest chicken processors for comment, including Tyson, Pilgrim’s Pride, and OSI Group — none responded to requests for comment. Perdue declined to comment through a spokesperson.

The Zurich team’s next steps include commercializing their technology with an industrial partner. Mezzenga and his colleagues have already begun talks with stakeholders, investors, and chicken feather suppliers to bring their technology to market, but are aware that challenges lay ahead. Benchmarking their membrane against existing synthetic options, as well as further testing for stability and design, will be crucial in demonstrating its viability and competitiveness.

When asked about the potential application of this technology in the U.S., Barone is skeptical. “The market forces today aren’t there,” he said. “When petroleum gets expensive, this stuff becomes more attractive, more viable. But right now, as of today … there’s no incentive.”