An accounting basis is a set of guidelines that a business follows when recording their financial transactions. There are two primary accounting bases: cash basis and accrual basis. When running a farm, choosing the right accounting basis is critical for managing finances.

What is cash basis?

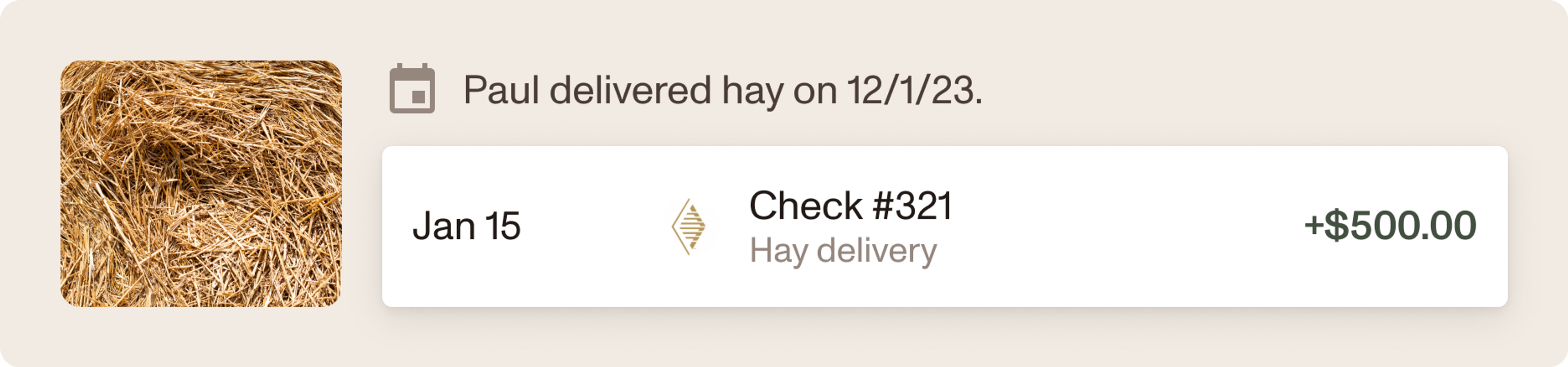

With cash basis accounting, income and expenses are recorded when deposits and payments hit your bank account. For example: Paul sells hay to his neighbor. Paul’s neighbor pays him with a check. Once the check is deposited into his bank account, Paul records the income.

A cash basis transaction.

What is accrual basis?

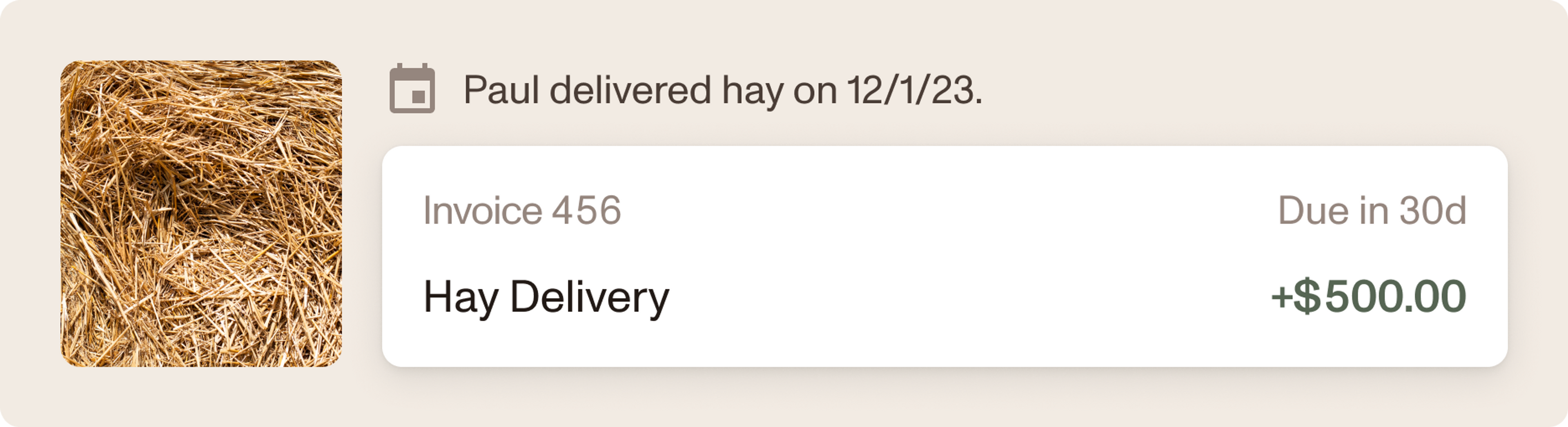

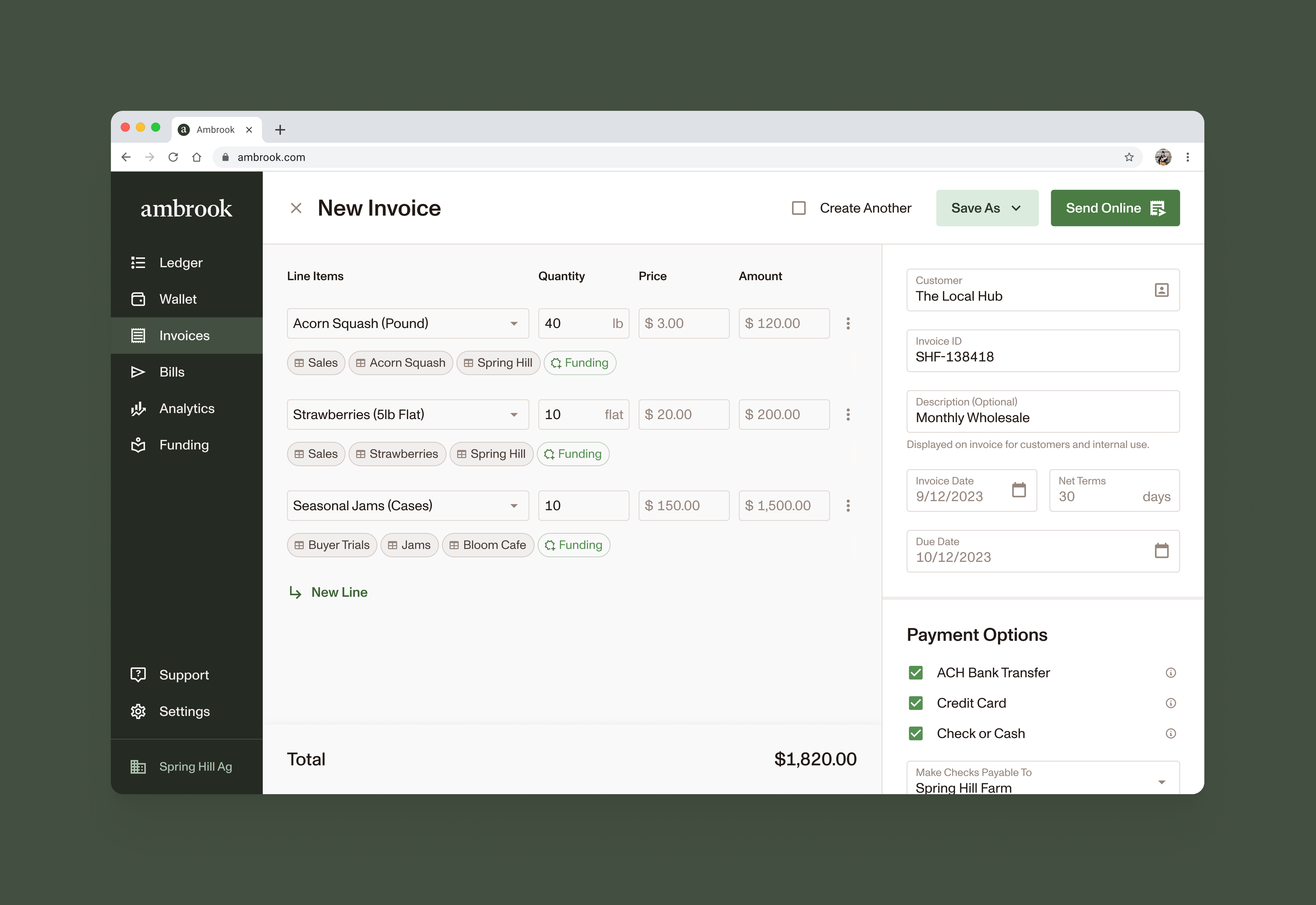

With accrual basis accounting, income and expenses are recorded when deliverables and/or services are performed. For example: Paul sells hay to his neighbor. Paul records the income when he delivers the hay; the recognition of income is separate from the payment.

An accrual basis invoice representing income.

Which basis is better for my farm?

Cash Basis

For most small to medium-sized farms, cash basis is suitable.

Advantages

Simple: Cash basis is easy to follow as transactions are recorded according to payments and deposits that have already impacted your bank account.

Clear Cashflow: Understanding your cashflow is straightforward with cash basis because it reflects your current financial position.

Tax Visibility: Cash basis can help farmers manage taxable income since income is not recognized until the cash has been received.

Disadvantages

Limited: Cash basis doesn’t give a complete picture of an organization’s performance over time. Imagine in the associated example above that Paul sold the hay in December, but did not receive the payment until January. In this case, his books wouldn’t give a clear picture of how his business performed month-by-month, quarter-by-quarter, year-by-year, and so on.

Accrual Basis

For larger operations or operations who wish to have a clearer picture of their financial performance, accrual basis is recommended.

Advantages

Comprehensive: Accrual basis provides a more accurate view of an organization’s financial performance over time. In the associated example above, Paul’s books recognized the sale of the hay in the month the sale occurred; not when the payment arrived. Increased precision when recordkeeping enables more exact analysis, planning, and decision making.

Future-proof: Since accrual basis is more comprehensive, some financial partners, like banks, investors, and government agencies may require farms of a certain size to follow accrual basis so they can calculate their risk. Additionally, the IRS requires businesses to use accrual basis when they reach a certain revenue threshold.

Disadvantages

Exhaustive: Accrual basis is more time-intensive as it relies on additional documentation, for example invoices and bills, to record income and expenses when they are rendered.

Unclear Cashflow: Accrual basis does not provide an accurate representation of cashflow since the income and expenses that are recognized may not have been deposited or paid. Therefore, farms using accrual basis will need a system for managing cashflow.

Choosing the Right System for Your Farm

When choosing a system for your farm, it’s helpful to consider:

Team Capabilities: Which system can your team consistently execute, from a record keeping standpoint?

Insights: What operational questions do you want to answer with your financial data?

Reporting Requirements: What data do you need to provide to external stakeholders (for taxes, loans, etc)?

Getting Started with Ambrook

Ambrook makes accounting with either basis approachable and efficient thanks to friendly interfaces that simplify bookkeeping, invoicing, and bill pay workflows. If you are eager to switch to a platform that helps you build healthy financial habits and empowers you to get the most out of your data, schedule a demo today.

Ready to simplify your acounting.

Schedule a DemoThis content was written by the team at Ambrook. We know farm finance, but are not CPAs or financial advisors.