A new, statewide tax credit program aims to bolster new farmers’ success, while addressing the issue of the rising average age of the American farmer.

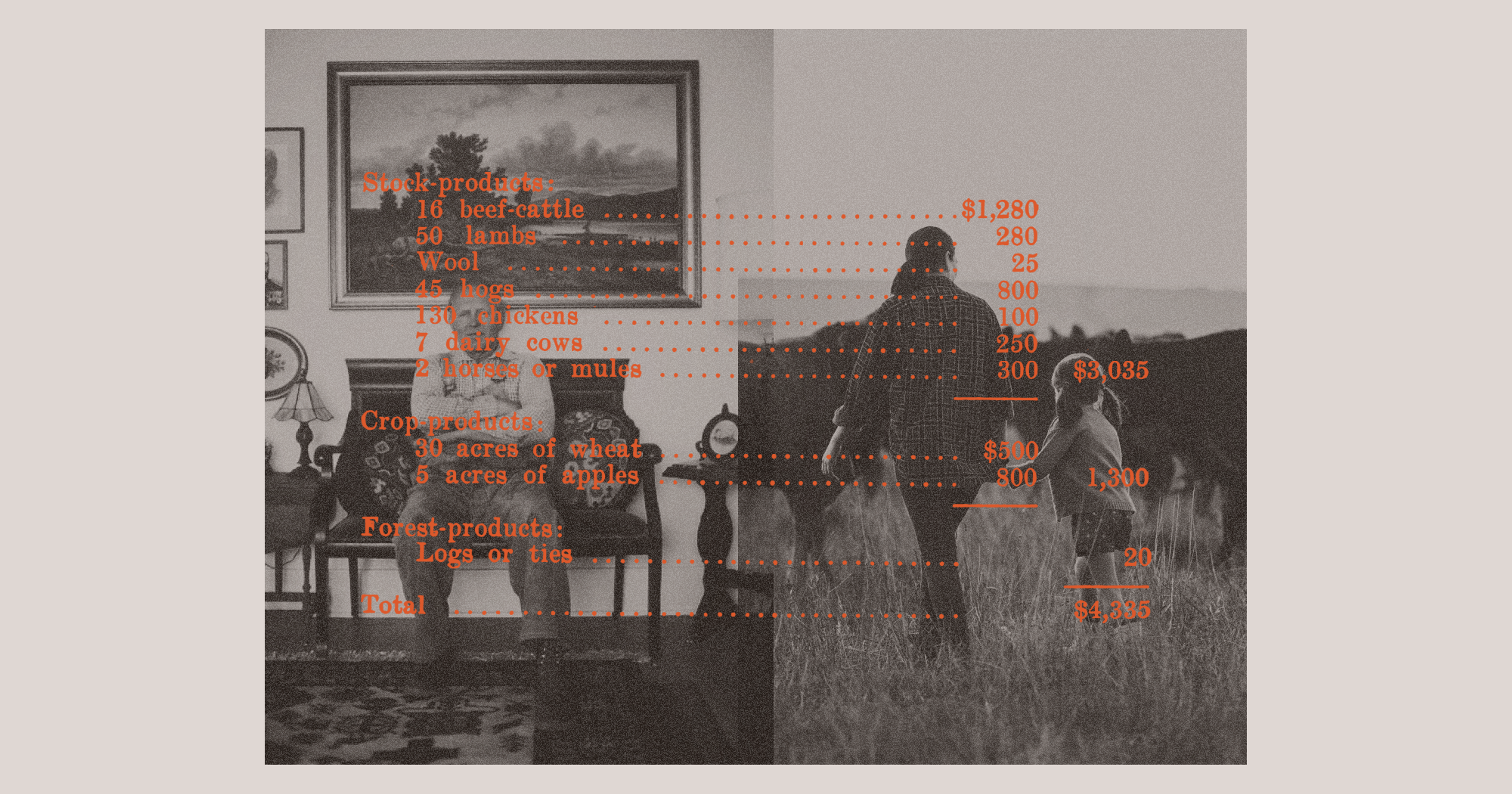

For the untested, the romance of farming may lie in the rolling hills of cropland, building bonds with livestock, pursuing lofty ideals as stewards of the land. But anyone working the land knows that farms are, first and foremost, businesses — and not easy ones.

The state of Ohio is looking to aid new farmers with that hard reality. In an effort to boost resources for beginning farmers — and hopefully increase the number of producers in the field — Ohio began a new program this year, offering tax credits that act as reimbursements for new farmers who attend financial management education programs.

Boosting the number of these young producers is a high priority for Ohio because of the agricultural industry’s outsized impact on the state. “Food and agriculture is a vital industry in Ohio — contributing roughly $124 billion annually,” said Sarah Huffman, executive director of Ohio’s Office of Farmland Preservation.

The finances are a vital area to focus on, as the business side of farming often comes with the most complications — and young farmers are particularly vulnerable to financial stress.

Instead of spending most of their time tending to their farm, the Marsiglios — a couple that left their teaching careers behind to produce meat, vegetables, and eggs on an old dairy farm in the Catskills — spent hours poring over invoices and expense reports. As Dan Marsiglio told Modern Farmer, “The farm needs are endless.” The couple said the farm grossed $40,000 annually, all of which was reinvested. This means the two amassed no savings, couldn’t hire any help, and had to take off-farm jobs to make ends meet.

Ohio’s tax credit program seeks to mitigate beginning farmers‘ financial woes by offering free financial planning and business courses. Other states have also recognized the benefits of a strong agricultural industry for their economy. The structure of Ohio’s program is modeled after existing programs in five other states: Nebraska, Minnesota, Kentucky, Iowa, and Pennsylvania.

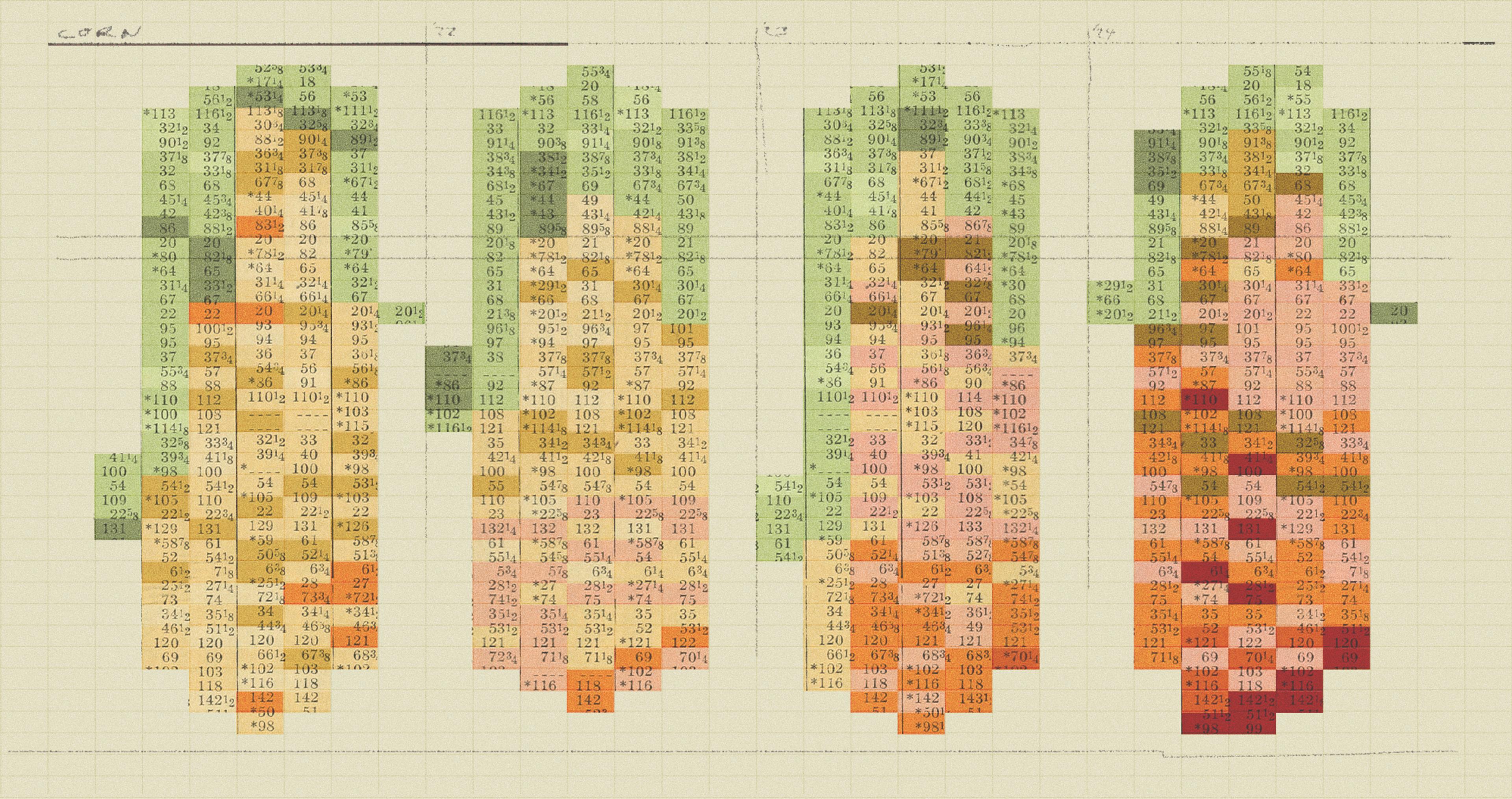

According to U.S. Department of Agriculture (USDA) data, agriculture, food, and related industries contributed more than $1 trillion to the U.S. gross domestic product (GDP) in 2021. The industry is also responsible for a high level of job creation, meaning more farmers is a net win for the country as a whole.

The tax credit programs in Ohio and other states also seek to address the ever-aging farming population in the U.S. According to USDA, the average age of farmers rose to nearly 58 years old in 2017, and as these farmers reach the time to retire, they need new producers to take their place — and stay there.

The two amassed no savings, couldn’t hire any help, and had to take off-farm jobs to make ends meet.

Huffman said Ohio hopes granting new farmers access to educational courses will not only incentivize them to start their own farms, but also to keep them viable in the long-term (a significant concern). In these financial courses — offered by a range of educational institutions — producers can learn farm business planning, marketing, financing, and other skills they’ll need to build a successful operation.

A financial management course is required as a part of the certification process for Ohio farmers to qualify as “beginning farmers,” which can open them up to more aid opportunities — like the U.S. Farm Service Agency’s beginning farmer loan program. In addition to financial education, to earn the official title, producers need to be residents of the state, have a household net worth under $800,000, and have been operating a farm for less than 10 years.

Andrew Hanson-Pierre, who operates Clover Bee Farms with his wife Margo, said it was a huge help to take a business and finance course before they got their operation — a small-scale vegetable farm in Shafer, Minnesota — up and running in 2015. “To have the business side of things, having that knowledge to fall back on, like learning to build your plan and how to run your farm, that is crucial,” he said.

When the pair took the course, the state of Minnesota hadn’t yet enacted its 2018 tax credit program, reimbursing farmers for taking financial education courses like in Ohio. Still, the two would highly recommend financial education to any new farmer.

They said said networking and building the confidence to start a farm were among the most pressing challenges at the start of their farming careers. Throughout the 12-month class, meeting other beginners in their area and planning the business end of their operation helped to solve both of those challenges.

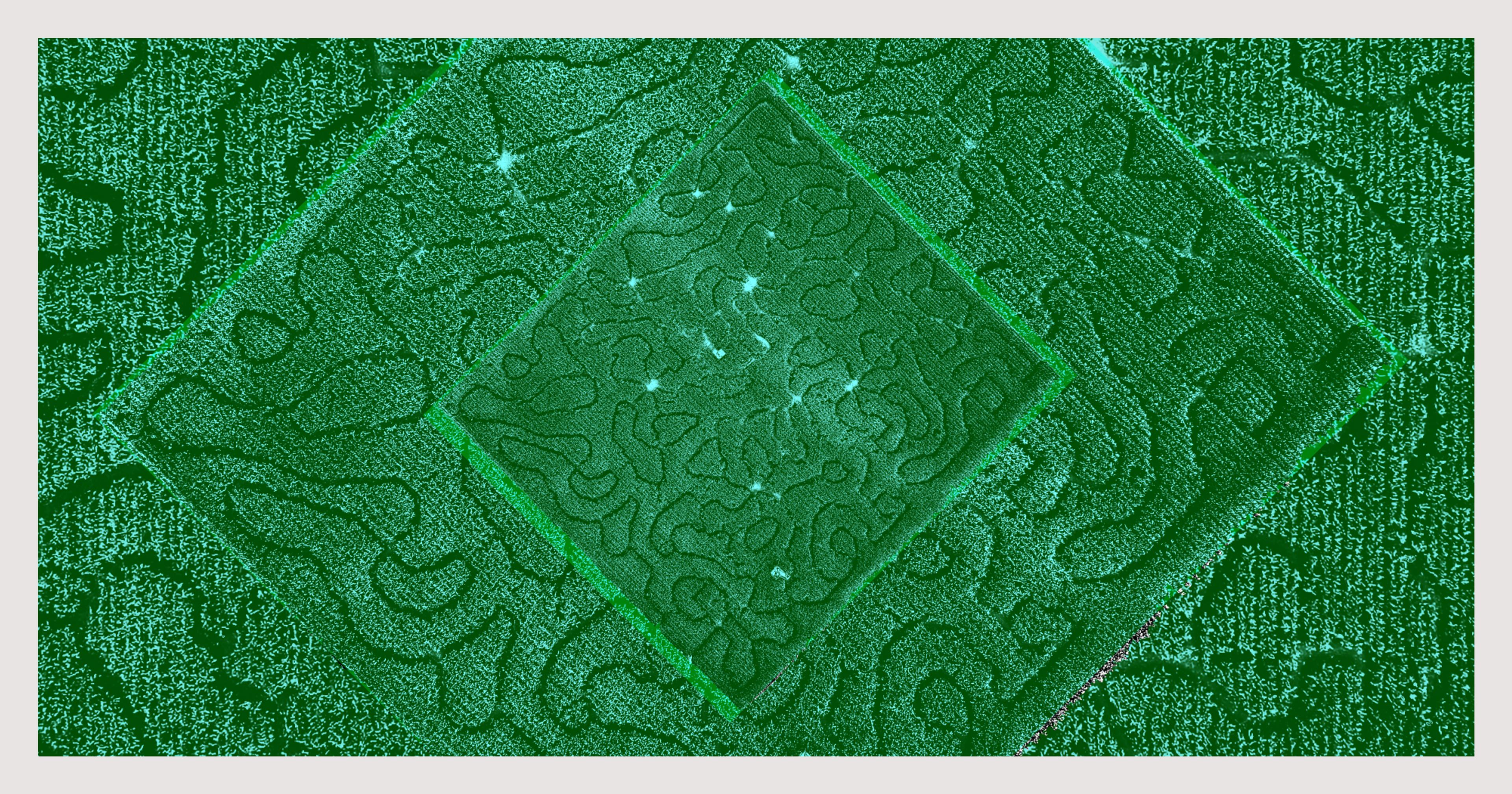

In addition to the proper financial planning, one of the most urgent issues farmers face when it comes to starting up is acquiring land. USDA data shows that, on average, the cost of cropland in the country was $5,050 an acre in 2022, up more than $600 per acre from 2021. In corn belt states like Ohio, that percentage is even higher, with land costing 15.3% more in 2022 than it did the previous year.

It’s getting harder for farmers in Ohio, and nationwide, to afford land to farm.

Rising costs mean it’s getting harder for farmers in Ohio, and nationwide, to afford land to farm — something Ohio’s new incentive program hopes to address.

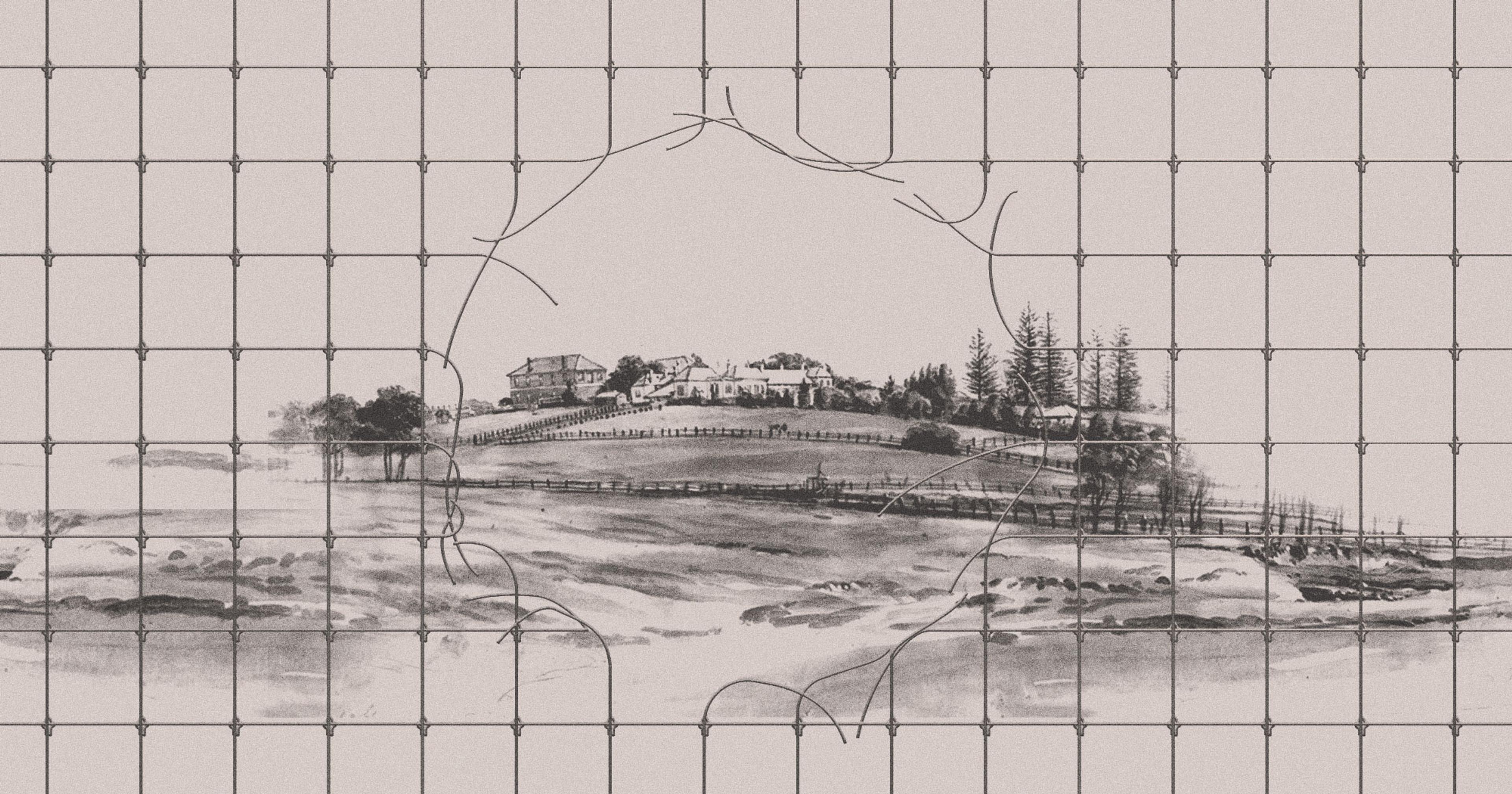

In addition to the tax credit for financial education programs, the new legislation provides an income tax credit to both individuals and businesses that sell or rent farmland, livestock, buildings, or equipment to beginning farmers. This part of the program aims to preserve farmland, and encourage current farmers to sell their land to future farmers — as opposed to developers or other industries.

“I think for the established farmers, you know, as our farming population ages, they’re all looking to transition at some point, and not every established older farmer has family members who want to take on the business,” said Huffman. And that’s where the second piece of the legislation comes in.

Under the program, an established farmer who transitions assets or enters into a rent share or lease agreement with a beginning farmer is entitled to a tax credit for 3.99% of that transaction. In Minnesota, where the same program has been active for around six years, these tax credits seem to be successful.

Jenny Heck, a rural finance authority with the Minnesota Department of Agriculture, said the asset owner credit program is “one of our most popular programs at the agency as far in terms of dollars. The state has given out between 500 to 600 credits each year since 2018,” she said. “Last year we did close to 628 asset owner credits.”

In Ohio, it’s still too soon to tell how useful the program will be. “It’ll be interesting to see, you know, in a year, where the tax credits are falling in terms of the financial management program costs versus asset transfer credits,” said Huffman. “We just don’t have that information yet.”

Ohio’s program, as the language of the legislation currently stands, will continue to serve the state’s farmers until January 2028, or a total reimbursement amount of $10 million — whichever comes first.

“I think it’s important for the future of farming to have new folks who are interested take it on and have the foundation and the tools necessary to succeed,” Huffman said.